Dividend Income Results

The following page is used to track our monthly and yearly dividend income results that are published here on The Money Sprout.

We have been tracking and reporting our results here on the website since 2014 and will continue to do so each month. Unfortunately, we missed a few reports between 2019 to 2020 … but have included the dividend income earned for reference.

You won’t see any detailed reports prior to 2014 either, since this website didn’t exist back then. However, we started earning dividend income way back in 2008 … so we have included that income for reference.

All of the dividend stocks that we currently own and track can be found on our dividend stock portfolio page. If you have any questions about which dividend stocks we own, please refer to that page for more information

You can also find important investing information and tools on our dividend stock resources page.

How do we pick our stocks for the portfolio? By following our 8 step process for screening stocks.

What tools do we use to help screen for stocks? By far the best tool at your disposal is the The DRiP Investing Resource Center list of U.S. Dividend Champions that is updated each month. One of the first things I do at the start of every new month is download this spreadsheet.

If you are serious about building a dividend growth portfolio of stocks … then you need this FREE list.

Below you will find a growing list of monthly dividend income results. Pay attention to how our dividend income has grown over the years.

Please enjoy!

Monthly and Annual Dividend Income Results

Our monthly and annual dividend income results we have earned since 2008 can be found below.

All of the income in these reports was earned in taxable brokerage accounts. This means that all of this income earned accessible and not tied up in any retirement accounts.

It also means that the income is potentially taxable … but because of qualified dividends we don’t have to worry much about that. That is why we are long term investors and like to hold our stocks forever.

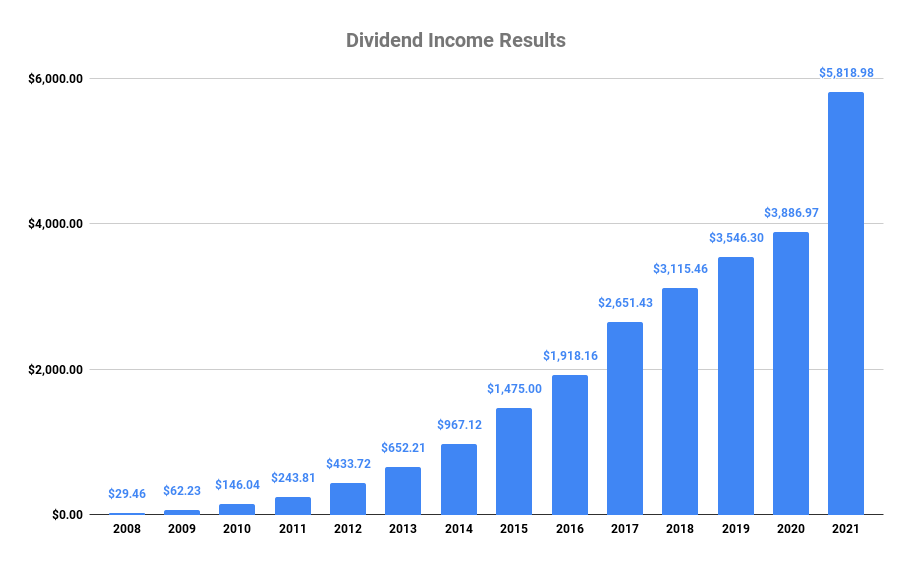

Here is a graph showing how our dividends have grown annually way back since 2008!

Now it’s on to our yearly and monthly breakdown.

2021 Results

[divider style=’centered’]

In 2021 we grew our dividends by 49.7%, which was a huge increase for our income. We took advantage of having extra cash to invest and continue building our dividend income portfolio. For the first time ever, we earned over $900 in a month!

Total Income Earned in 2021 – $5,818.98

Annual Dividend Growth – 49.7%

- January 2021 – $221.24

- February 2021 – $305.98

- March 2021 – $583.66

- April 2021 – $291.10

- May 2021 – $459.26

- June 2021 – $676.86

- July 2021 – $344.25

- August 2021 – $480.67

- September 2021 – $770.60

- October 2021 – $293.21

- November 2021 – $490.24

- December 2021 – $901.91

2020 Results

[divider style=’centered’]

The following results represent the dividend income we earned in 2020. Despite a global pandemic during the year, our dividend income portfolio held up rather nicely. We set a new annual dividend income record during the year.

Total Income Earned in 2020 – $3,886.97

Annual Dividend Growth – 9.6%

- January 2020 – $185.56

- February 2020 – $216.99

- March 2020 – $498.24

- April 2020 – $204.72

- May 2020 – $221.42

- June 2020 – $538.97

- July 2020 – $185.54

- August 2020 – $236.55

- September 2020 – $542.92

- October 2020 – $186.38

- November 2020 – $273.89

- December 2020 – $595.79

Note – we did not provide updated posts between April to December in 2020. We have listed our total dividend income for the month still for reference.

2019 Results

[divider style=’centered’]

In 2019 we grew our dividends by just under 14%, which was in line with our income growth goals (over 9% annually). For the first time ever we earned over $500 in a month … 3 months to be specific!

Total Income Earned in 2019 – $3,546.30

Annual Dividend Growth – 13.8%

- January 2019 – $160.51

- February 2019 – $207.92

- March 2019 – $470.58

- April 2019 – $179.31

- May 2019 – $209.49

- June 2019 – $508.02

- July 2019 – $150.16

- August 2019 – $220.24

- September 2019 – $518.46

- October 2019 – $152.41

- November 2019 – $222.78

- December 2019 – $546.42

2018 Results

[divider style=’centered’]

This year we saw our dividends grow by over 17% compared to 2017. Our goal from hear on out is to try and keep our dividend growth above 9% … which should be achievable based on my calculations.

We also managed to pass another milestone in 2018 … we earned more than $3,000 in dividends for the first time ever!

Total Income Earned in 2018 – $3,115.46

Annual Dividend Growth – 17.5%

- January 2018 – $125.94

- February 2018 – $174.65

- March 2018 – $412.78

- April 2018 – $146.08

- May 2018 – $184.77

- June 2018 – $462.20

- July 2018 – $136.90

- August 2018 – $193.45

- September 2018 – $462.91

- October 2018 – $145.75

- November 2018 – $197.87

- December 2018 – $472.16

2017 Results

[divider style=’centered’]

The dividends from our portfolio grew by over 38% in 2017 … which was a big uptick from the prior year. At this point in the journey, you need to invest a ton of new capital to keep the percentage growth up.

What an awesome year by the way … it was not only our first ever year to earn $300 in a month … we had two months over $400!

Total Income Earned in 2017 – $2,651.43

Annual Dividend Growth – 38.2%

- January 2017 – $140.12

- February 2017 – $136.30

- March 2017 – $279.72

- April 2017 – $154.49

- May 2017 – $152.85

- June 2017 – $342.75

- July 2017 – $153.50

- August 2017 – $163.01

- September 2017 – $406.68

- October 2017 – $105.22

- November 2017 – $168.21

- December 2017 – $448.58

2016 Results

[divider style=’centered’]

Our dividends grew by 30% in 2016 … which was a drop off from our 50% averages. The thing is … as your dividends grow higher and higher, it is harder to keep those crazy growth numbers.

The good news is that this was the first year in which we earned at least $100 per month of dividends!

Total Income Earned in 2016 – $1,918.16

Annual Dividend Growth – 30.0%

- January 2016 – $111.51

- February 2016 – $104.72

- March 2016 – $209.10

- April 2016 – $131.46

- May 2016 – $108.43

- June 2016 – $245.38

- July 2016 – $111.05

- August 2016 – $114.59

- September 2016 – $276.78

- October 2016 – $111.78

- November 2016 – $124.48

- December 2016 – $268.88

2015 Results

[divider style=’centered’]

So in 2015, we blew past $1,000 for the year and ended up growing our dividends by over 50% again. And guess what? We had our first $200 dividend month twice that year … not to mention several months over $100.

Total Income Earned in 2015 – $1,475.00

Annual Dividend Growth – 52.5%

- January 2015 – $85.44

- February 2015 – $46.16

- March 2015 – $168.33

- April 2015 – $92.69

- May 2015 – $48.52

- June 2015 – $182.38

- July 2015 – $102.80

- August 2015 – $90.83

- September 2015 – $226.27

- October 2015 – $96.03

- November 2015 – $98.12

- December 2015 – $237.43

2014 Results

[divider style=’centered’]

Another record month for dividends as we almost hit 50% growth … but fell a bit short. This was the first year that we had a month (4 of them) with over $100! That was an awesome feeling and I can’t wait until we hit $1,000 month years from now.

Total Income Earned in 2014 – $967.12

Annual Dividend Growth – 48.3%

- January 2014 – $70.11

- February 2014 – $35.68

- March 2014 – $105.29

- April 2014 – $77.60

- May 2014 – $37.48

- June 2014 – $118.91

- July 2014 – $77.98

- August 2014 – $41.10

- September 2014 – $133.83

- October 2014 – $79.16

- November 2014 – $43.16

- December 2014 – $146.82

2013 Results

[divider style=’centered’]

Dividends certainly didn’t slow down in 2013 as we grew our income by over 50% again! We continued our momentum and came oh so close to cracking $100 month in December.

Total Income Earned in 2013 – $652.21

Annual Dividend Growth – 50.4%

- January 2013 – $24.74

- February 2013 – $36.20

- March 2013 – $83.70

- April 2013 – $31.48

- May 2013 – $38.31

- June 2013 – $69.57

- July 2013 – $55.61

- August 2013 – $41.75

- September 2013 – $70.97

- October 2013 – $63.37

- November 2013 – $43.73

- December 2013 – $92.78

2012 Results

[divider style=’centered’]

We managed to grow our dividend income in 2012 by over 75%! This was the first year that we earned at least $10 of dividend income each month. And it was the first time we ever earned over $50 in a single month … which actually happened 4 times!

Total Income Earned in 2012 – $433.72

Annual Dividend Growth – 77.9%

- January 2012 – $11.29

- February 2012 – $25.26

- March 2012 – $55.11

- April 2012 – $14.90

- May 2012 – $28.46

- June 2012 – $56.23

- July 2012 – $18.46

- August 2012 – $32.26

- September 2012 – $62.34

- October 2012 – $22.28

- November 2012 – $34.30

- December 2012 – $72.83

2011 Results

[divider style=’centered’]

Another solid year in 2011, where we grew our dividend income by over 60%! We were able to earn dividends each month of the year, for the first time ever!

Total Income Earned in 2011 – $243.81

Annual Dividend Growth – 66.9%

- January 2011 – $6.72

- February 2011 – $16.35

- March 2011 – $33.59

- April 2011 – $6.78

- May 2011 – $17.98

- June 2011 – $34.41

- July 2011 – $6.85

- August 2011 – $18.43

- September 2011 – $34.75

- October 2011 – $8.79

- November 2011 – $20.37

- December 2011 – $38.79

2010 Results

[divider style=’centered’]

For a second year in a row, we managed to grow our dividend income by over 100% compared to the prior (2009)! This was also the first year when we started earning dividend income from multiple companies. We managed to earn dividends in each month of the year in 2010, except February.

Total Income Earned in 2010 – $146.04

Annual Dividend Growth – 134.7%

- January 2010 – $6.25

- March 2010 – $16.27

- April 2010 – $6.31

- May 2010 – $7.23

- June 2010 – $24.59

- July 2010 – $6.36

- August 2010 – $7.28

- September 2010 – $24.89

- October 2010 – $6.41

- November 2010 – $7.34

- December 2010 – $33.11

2009 Results

[divider style=’centered’]

We managed to grow our dividend income by over 100% compared to 2008! While we added a few more stocks to our portfolio late in the year, Consolidated Edison (ED) was still our only dividend payer for 2009.

Total Income Earned in 2009 – $62.23

Annual Dividend Growth – 111.2%

- March 2009 – $15.18

- June 2009 – $15.44

- September 2009 – $15.69

- December 2009 – $15.92

20008 Results

[divider style=’centered’]

Back in 2008, The Money Sprout did not exist yet so there were no dividend income reports. This was our first year of earning dividend income (knowingly) and all of it was earned from a single stock – Consolidated Edison (ED).

We still own all of our shares of ED today … along with several added from DRiP.

Total Income Earned in 2008 – $29.46

Annual Dividend Growth – N/A

- September 2008 – $14.63

- December 2008 – $14.83