Dividend Stock Portfolio

Welcome to our dividend stock portfolio page!

My wife and I bought our first dividend paying stock back in 2008. The company was Consolidated Edison (ED) and we still own it today!

Even better … the company still continues to deposit dividends into our taxable brokerage account every 3 months.

That first year of owning this dividend stock (ED), we received a total of $29.46.

Over the years, we earned more dividends from the company than the total cost to purchase our original 25 shares! Not only has the stock essentially paid for itself, the dividend payments have also helped us to add other stocks to our portfolio over the years.

Types of Dividend Stocks

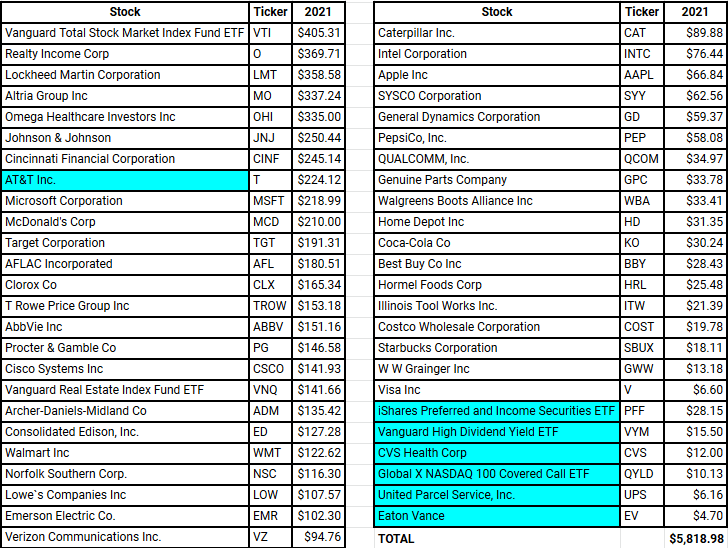

Today our portfolio looks much different than it did back in 2008. We now own 40 dividend paying companies from a variety of different sectors and 2 dividend paying ETF’s – VTI and VNQ.

We own stocks with high current yields including – Altria (MO) and AbbVie (ABBV).

Our portfolio includes a few of my favorite dividend growth stocks like – Costco (COST), Microsoft (MSFT), and Visa (V).

We have diversified our portfolio to include a few Real Estate Investment Trusts (REITs) as well including – Realty Income (O) and Omega Healthcare (OHI).

The portfolio is rounded out by what I consider foundational dividend stocks. These are blue chip companies that have been around forever like – McDonald’s (MCD), Johnson & Johnson (JNJ), and Procter & Gamble (PG).

The list of all the companies we currently own has been provided below if you are interested to know what makes up our the rest of our portfolio.

Low Cost Brokerage Accounts

Over the years of building this dividend stock portfolio, we have used a variety of low cost brokerage accounts. After several years, we have narrowed down the brokers we use to our favorite – Fidelity.

We had used a few others like LOYAL3 who closed down, Robinhood who is still in operation today, and M1 Finance.

For years I loved using Robinhood to build our portfolio but there were several things I didn’t like about the platform and eventually closed our account.

[divider style=’full’]

Our Stock Holdings

You can find monthly and annual dividend income reports for stocks in our portfolio on our Dividend Income Results Page.

The chart below represents companies that we currently own in our dividend stock portfolio.

All of these companies are held in a taxable brokerage account (Fidelity) … which means we pay taxes on a portion of this income. However, the majority of this income is from qualified dividends, which are very tax friendly.

I have included the amount of income we earned last year (2021). This list of stocks is a snapshot in time and is updated periodically. Some of the information found here may be outdated.

Any company highlighted in blue was sold from our portfolio last year (2021) and is no longer being held.

Note – our dividend stock portfolio is not a recommendation to buy any of these companies. This index currently reflects our own stock holdings and provides accountability to information found on this site. Please do your own research when investing in the stock market.

For more information on building a dividend income portfolio, please visit the – Dividend Stock Resources Page.

More Dividend Stock Portfolio Examples

If you want to check out a few other dividend growth investors who I follow and respect, check out the following resources to see what stocks they hold in their portfolios –