This post may contain affiliate links. Please read our disclosure for more info.

Despite the global pandemic, 2020 turned out to be a great year for our dividend income results.

After the first few months of the year, I was certain we’d see a bunch of dividend cuts. I think there were probably several close calls with some of the stocks we own.

The good news is not a single company in our portfolio cut their dividend last year. We did have a few companies that chose not to raise their dividend however, which I will cover below.

Overall I’d say it was a positive year for building this income stream.

We were able to increase our dividend income by almost 10% from the previous year, and we took the opportunity to invest a lot of new dollars.

It will take some time, but these new investments (along with reinvesting all of our dividends) will eventually compound and grow like crazy!

Let’s take a look at some of the highlights of our dividend income portfolio in 2020.

Dividend Income Portfolio

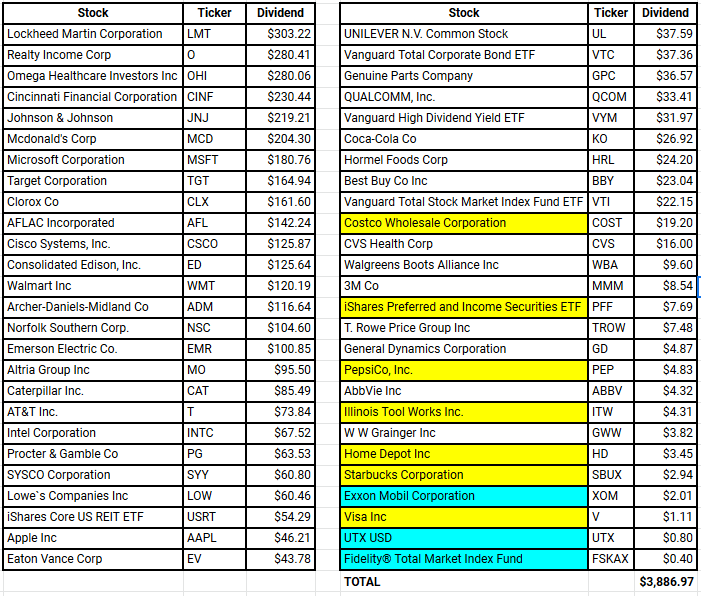

We currently own 44 dividend paying stocks in our portfolio (December 2020).

In addition, we own 5 dividend paying ETFs which include – VTI, VTC, VYM, USRT, and PFF.

All of the stocks and ETFs that we report on are included in two different taxable brokerage accounts – Fidelity and M1 Finance.

Note – in the past we used a couple different brokerage accounts (including Robinhood), but consolidated them into our two favorite. I know that Robinhood has become very popular over the past couple of years (and I had promoted them). However, there are several reasons we closed our Robinhood account last winter (2020).

In the past, we had reported on and invested in dividend stocks in my tax deferred IRA account, but switched gears in 2019. We have a different approach and philosophy now for our tax deferred retirement accounts. So all of our dividend income results are from taxable accounts.

We closed out of a few stocks and mutual funds in our dividend income portfolio last year. The most notable was Exxon Mobil (XOM).

There were several new dividend paying stocks we added to our portfolio last year including –

- Costcto (COST)

- PepsiCo (PEP)

- Illinois Tool Works (ITW)

- Home Depot (HD)

- Starbucks (SBUX)

- Visa (V)

Finally, all of the income stocks that we own in our portfolio raised their dividends in 2020 except the following companies –

- Caterpillar (CAT)

- CVS Health (CVS)

- Eaton Vance (EV) – did declare a special dividend

- Norfolk Southern (NSC)

- Omega Healthcare (OHI)

- SYSCO (SYY)

- AT&T (T)

As long as these companies do not cut their dividend in the future, we will continue to hold our shares … but not add any new shares. The only exception to this rule is for Eaton Vance (EV) which declared the special dividend late in 2020. We may add a few shares of EV this year depending on the market.

Now let’s take a look at our dividend income results for last year.

2020 Dividend Income Results

Last year, my wife and I recorded our highest dividend income earned so far.

After the first couple of months into the pandemic, we realized we would be in good shape overall. Since we didn’t see any dividend cuts and we continued to invest throughout the year, it was no surprise we would break our record from last year (2019).

Based on our investment philosophy, we should never see a decrease in annual dividend income. Even if we never invest another penny, our dividend income should grow each year.

In total, we earned $3,886.97 in dividends paid out from 52 different stocks and ETFs in our taxable portfolio last year.

This was an increase of $340.67 since last year. That is a nice 9.6% increase compared to 2019.

As long as we continue to grow our dividend income each year by over 9% … we will hit our long term dividend income goal. More on this further in the article when I discuss the Rule of 72.

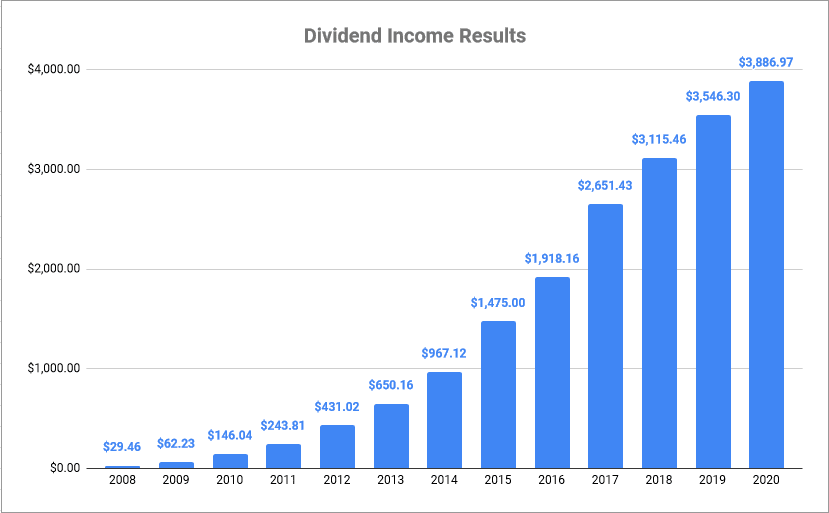

Speaking of growth, look at our dividend income over the past 13 years –

As you can see, we have steadily grown our dividend income each year since starting out in 2008. We expect to see similar growth in the future as long as we continue to invest new capital into the market.

Here is a breakdown of all the stocks and ETFs we earned a dividend from last year.

Any company highlighted in blue represents a stock we sold during 2020 and no longer own. Those in yellow are new additions to our portfolio last year.

Looking ahead in 2021, we are going to focus on high dividend growth stocks. These are companies with double digit dividend growth but likely have very low yield.

Growing Future Dividend Income

One of my favorite things about reporting our dividend income each month is looking at our future dividend income.

I certainly get excited reporting our past dividend income results, but the real fun is looking to the future … which looks very bright.

Based on our 12-month forward dividend calculation, we will earn approximately $4,333.23 in dividends during 2021.

That is a 11.48% increase of future dividend income compared to 2020.

One important thing to note … this calculation doesn’t include any future reimbursement of dividend income back into more stocks.

Nor does it include any new investment dollars or dividend increases made by the companies in which we own shares.

There are only two things that need to happen in order for us to earn this amount in dividend income –

- we don’t sell any of our stocks in the portfolio

- companies we own don’t cut or lower their dividend

None of the companies we own cut or reduced their dividends in 2020 and it is doubtful that will happen in 2021. If a company were to make a dividend cut, then we’d likely sell our position and use the funds to purchase a different dividend growth stock.

Based on all these factors, I’d predict we will earn a minimum of $4,333.23 in dividends this year.

Honestly, I would expect it to be larger because this estimate doesn’t take into account the following –

- dividend increases

- new investments

- reinvested dividends

Based on these 3 factors, I have set a goal for us to earn $4,500 of dividend income in 2021!

Rule of 72 – How Fast Will Our Income Double?

At the beginning of 2018, I started tracking the rule of 72 projections for future dividend income in our taxable brokerage accounts.

The Rule of 72 is a calculation that estimates how often your investments will double. While most investors use this to calculate the value of their portfolio, I like to use it to project our dividend income.

Using the rule of 72, I have calculated (conservatively) that our dividend income will double every 9 years … without doing anything. A less conservative estimate puts it at every 7 years or so … but I like to plan in a buffer.

Based on this rule, I can calculate out how our dividend income could grow (and double) based on our future annual dividend income number of $4,333.23 … that would be earned on December 31, 2021.

Take a look at how our income could double overtime –

- 12/31/2021 – Annual Dividend Income = $4,333.23

- 12/31/2030 – Annual Dividend Income = $8,666.46

- 12/31/2039 – Annual Dividend Income = $17,332.92

- 12/31/2048 – Annual Dividend Income = $34,665.84

Our updated figures tell us we should be earning very close to $35,000 per year in dividend income by the end of 2048.

Keep in mind, this is more of a fun what-if type of scenario. I believe we have figured conservatively … and our income should grow at a faster rate. And it should be fun to watch this number grow every month when we post results.

Wrapping Up 2020

We finished the year with a portfolio of 44 dividend stocks, and 5 ETFs.

Despite a lot of market volatility and a global pandemic … our dividend income stream held up very nicely.

This was our highest dividend income year ever. We earned $3,886.97 last year … a 9.6% increase compared to 2019!

Based on our future annual dividend income projections … we expect to earn at least $4,330 in 2021. However with additional investments and expected company dividend increases … I fully expect to top the $4,500 dividend income total.

I am really excited about growth beyond 2021 too!

Just look at the estimates from our Rule of 72 projections – in about 9 years we should be earning just under $9,000 per year in dividend income. That would cover a good portion of our current spending ($80,000).

Those calculations also are very conservative … which would mean no new money ever invested again. No company dividend increases. It would also assume we keep our spending at it’s current level … which I would expect to drop some in the future.

I look forward to a healthy and successful 2021!

How did your 2020 dividend income results turn out?