This post may contain affiliate links. Please read our disclosure for more info.

Welcome to my series on – Rules for Second Generation FI.

Welcome to my series on – Rules for Second Generation FI.

My wife and I have 3 kids and one of our goals is to teach them the fundamentals of becoming financially independent. My personal belief is that we don’t do enough as a society to teach our kids about money and personal finance.

So I want to make sure to give our kids (and anyone else listening) the information they need to start their adult years ahead of the game.

We want our children to be able to go to college (if they like) and come out with very little debt. We want to give them the knowledge that lifestyle inflation can cost them years of their life when they start earning income. We want to teach them to avoid buying a house that is too big or expensive cars.

There are so many lessons and rules to teach them about personal finance … so we decided to start writing them down in a series of second generation FI rules.

The rules that we plan to cover in this series are not in any particular order, but will each serve a purpose.

Today I would like to cover our first lesson – which is setting a goal to save (and invest) 50% of their income … but hopefully more!

Rule #1 – Save 50% of Your Income (Hopefully More)

The first lesson that I would like to teach my children about financial independence is savings.

I’m not talking about saving 5% or 10% of your paycheck, but rather extreme savings. Like at least 50% of their income … and even more if they can.

I recently wrote a post about my savings rate over the past 20 years. Since working full-time (after graduating college), I have saved a minimum of 10% to 15% of my income. Not bad … but I could have done more.

much, much, more to be honest …

Saving 50% of my income the past 20 years would have actually put my family in a position today of being financially independent. We would have had a conservative estimate of 1.3 million dollars in assets … which is between the range of wealth we need to meet the 4% rule!

That’s a mistake I certainly would love to take back and a lesson I would like to pass along to the second generation FI community.

I truly believe that if my children take just this one piece of advice … they will reach financial independence much sooner than my wife and I will.

Tips for Saving 50% or More of Your Income

Saving 50% or more of your income can certainly pose some challenges. Especially when you start falling victim to lifestyle inflation.

That is why I feel it is important to start when you are young and don’t have a lot of factors holding you down – like a mortgage, kids, car payments, etc.

Here are a few tips I would like to share with my kids on getting them thinking about saving 50% or more of their income … when they start working full-time.

1. Get the Maximum Company Match

Get any company match from a 401K or retirement plan at work. If your company offers a 5% match into your 401K … then set it up first thing to contribute your 5% so you can get the match. This is basically like earning free money.

One of my earliest jobs offered to double the employee’s contribution into a 401k … up to 5%. So when I setup my 5% investment into my 401K at work … my employer contributed 10%!

I took advantage of the awesome match up to the maximum amount … which gave me a total of 15% of the value of my paycheck (pre-tax) going into my 401K each time I got paid.

If you have a match at your employer … make this your first priority towards your savings goals.

2. Optimize Your Taxes and Income

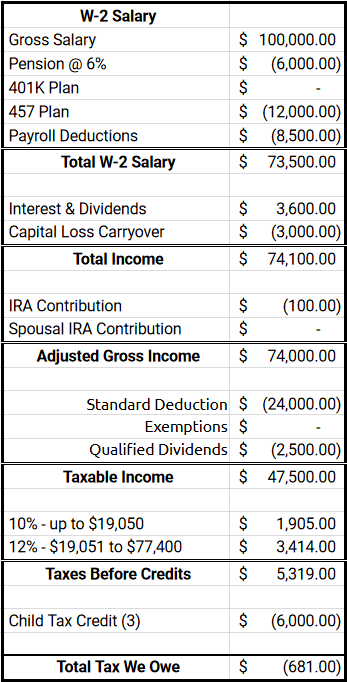

One thing I wished I would have picked up on much sooner in my working career was optimizing our taxes. Specifically the amount of federal taxes we pay each year on our income.

One thing I wished I would have picked up on much sooner in my working career was optimizing our taxes. Specifically the amount of federal taxes we pay each year on our income.

For example, last year we paid $3,114 in federal tax. The year before … we paid $2,894 in federal tax.

Guess how much we are going to pay this year in federal taxes? We have our income optimized now to owe $0 in taxes this current year, and it is completely legal.

By understanding the current tax law and making a few smarter choices in where and how we invest our income … we are able to keep more of it in our tax advantage retirement accounts.

This strategy won’t necessarily work for our state taxes nor any payroll taxes … but we will hold onto an extra $3,000 of income this year by being just a little bit smarter with our money.

Just think about how much we could have grown our accounts over the past 20 years through tax optimization?

Note – The chart to the right details our tax situation for the current year. The salary is rounded to make it simpler to follow but is very close to our actual income. We also have room to earn another $40,000 of additional income and still can avoid paying any federal taxes by filling up our pre-tax buckets.

3. House Hack

Last year, my wife and I spent over 37% of our income on housing expenses.

Right off the bat … this is not ideal for anyone looking to save 50% of their income. Spending that much on housing leaves less than 12% of your income for living expenses. This is assuming you are trying to save 50% of what you earn.

Now there are some reasons why we still live in our same home and those costs include home maintenance, utilities, mortgage, taxes, insurance, etc. But for anyone starting out on their own without a family to worry about … spending 37% of their income on housing is not ideal.

There are plenty of ways to house hack including – living with roommates, buying a live in flip, moving back with your parents (eek), and more.

The point is by keeping your housing expenses as low as possible, you can lower (or even eliminate) one of your biggest expenses. Which then allows you to put more of your income towards savings.

Looking back … I really wished I would have thought about house hacking when I was in my early 20’s. Instead, I was too busy wasting a good portion of my income on DVD’s, CD’s, and beer.

4. Keep Transportation Costs Low

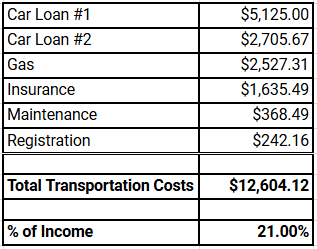

On top of our housing costs, we spent another 21% of our income on transportation last year. That is 58% of our income combined going towards housing and transportation.

So logically, hacking your travel expenses is important towards your savings goals.

Just like housing … there are plenty of ways to keep your travel expenses low. You could combine a house hack with living in a location close to your work. That way you could bike or walk to work.

Leveraging public transportation is another option if you can plan out where you live in relation to your job.

If you do have to drive to work … then buy a used car instead of new. Make somebody else pay for that instant depreciation on buying a new car.

What about paying for travel to go on vacations? Well … travel hacking can be leveraged into thousands and thousands of free trips every single year! Once again, this is something I really wished I’d known about when I was 20!

Investing Your Savings

Okay, so now that we are thinking along the path of saving 50% or more of our income, the next step is to make those dollars work for you.

That means sticking your savings in a checking or savings account earning less than 1% is not doing much help. You need to find a way to put your dollars back to work for you … earning compound interest.

One popular choice is investing in broad based passive index funds. Low-cost index funds are a great way to invest your savings that offers diversification in the stock market. Most importantly, it is “hands-off” so you don’t have to monitor a bunch of stocks.

My personal preference is building a dividend income portfolio of stocks with our savings.

This year alone … we will earn around $6,700 of dividend income from the stocks we own. Based on the Rule of 72 projection, if we left our portfolio alone … that income would double to almost $14,000 a year in 9 to 10 years!

You could also use your savings to buy a rental property that could generate monthly cash-flow. Even better would be to combine a house hack and a rental property where you could have someone else pay your own rent.

Another option would be to invest your savings into a personal business. There are tons of ideas out there … you just have to be creative.

Just promise you won’t leave 100% of your savings in a checking or savings account!

Recap of Saving 50% of Your Income

This is the first rule in my Second Generation FI series and has coincided with my oldest son starting high school. The clock has started and we now have 4 years to teach him about personal finance.

Our goals are to give him and our other two children the tools they need to put themselves on the path to financial independence. Whether it be saving 50% of their income when they start working full-time, house hacking in their 20’s, hacking college to come out debt free, or not overspending on transportation costs … we hope pass as many tips along to our kids as we can.

Saving 50% or more of your income and then investing it to earn compounding interest is a serious life hack that is so powerful … that it can completely change your life.

Do you save 50% or more of your income? How has extreme savings changed your life?