This post may contain affiliate links. Please read our disclosure for more info.

The rule of 72 example that I have highlighted below shows how fast your retirement portfolio can double.

In reality … this example can be used for any type of investment provided you know the average rate of return.

Whether it be an individual stock, mutual fund, ETF, or in this case a low cost index fund … the rule of 72 can help you plan for retirement.

It is important however to understand that using this calculation will provide estimates only. When it comes to investing, there are never any guarantees of future performance. With that being said, we can still make conservative and educated projections on where our investments will end up in the future.

Normally, I discuss investing in dividend stocks. But today, I would like to switch gears and talk about retirement portfolios … in this case an IRA.

I have found that using the rule of 72 projections can be helpful to see how fast our retirement portfolio will double.

Years to Double an Investment

Personally, I like to use the rule of 72 to predict how fast our annual dividend income will double.

Over the years, I have estimated that annual income we earn from our dividend stock portfolio will double every 8 or 9 years. This is based on a 9% dividend growth rate … which I won’t explain here.

But based on my estimates … we will expect to be earning close to $10,000 a year in dividends within 9 years (likely less). And in 18 years or so, we should be earning a minimum of $20,000 a year in dividend income.

These are very conservative estimates.

Check out these resources on doubling your dividends –

- How to Build a Passive Income Stream That Doubles Every Decade

- How to Build Sustainable Income through Compounding Dividends

- Using the Rule of 72 to Double Your Dividend Income

So enough about dividend investing … let me switch gears to discuss the number of years it will take to double your retirement portfolio.

While there are no guarantees on future returns … I have found the rule of 72 formula to be useful when it comes to our IRA too. It provides a close estimate on the doubling time for an investment.

In many ways … it is much simpler using the rule of 72 to calculate the number of years to double a low cost index fund … compared to a dividend stock portfolio.

Now let’s look at an example of a low cost index fund held in an IRA.

Rule of 72 Example

As I stated earlier, most of the time I use the calculation to estimate the doubling time for our dividend income stream.

However, today I wanted to show a rule of 72 example for a regular (and normal) retirement account.

In this example, I will use a low cost index fund that I currently own in my IRA account.

Low Cost Index Fund

One of the low cost index funds that I hold in my IRA account is the Fidelity® Total Market Index Fund (FSKAX).

This is Fidelity’s equivalent of the ever popular Vanguard (VTSAX) low cost index fund.

In order to calculate how long it will take for an investment in FSKAX to double, we need to look at the historical returns.

While we know future returns are NEVER guaranteed, we will need to estimate a future return for this example.

Here are a few of the average annual total returns for FSKAX as of February 2021 –

- 1 Year – 20.5%

- 3 Year – 12.3%

- 5 Year – 16.7%

- 10 Year – 13.5%

- Lifetime – 8.4%

We could potentially use any one of this historical returns in our formula. However, I feel the more historical data we have the better.

Remember not every year will return the percentages you see listed above. Some years will have a negative return while other years will be way over those percentages.

I like to play things safe … so we will use the 8.4% annual average return over the lifetime of the fund.

Now let’s look at the rule of 72 formula.

Rule of 72 Formula

A quick recap …

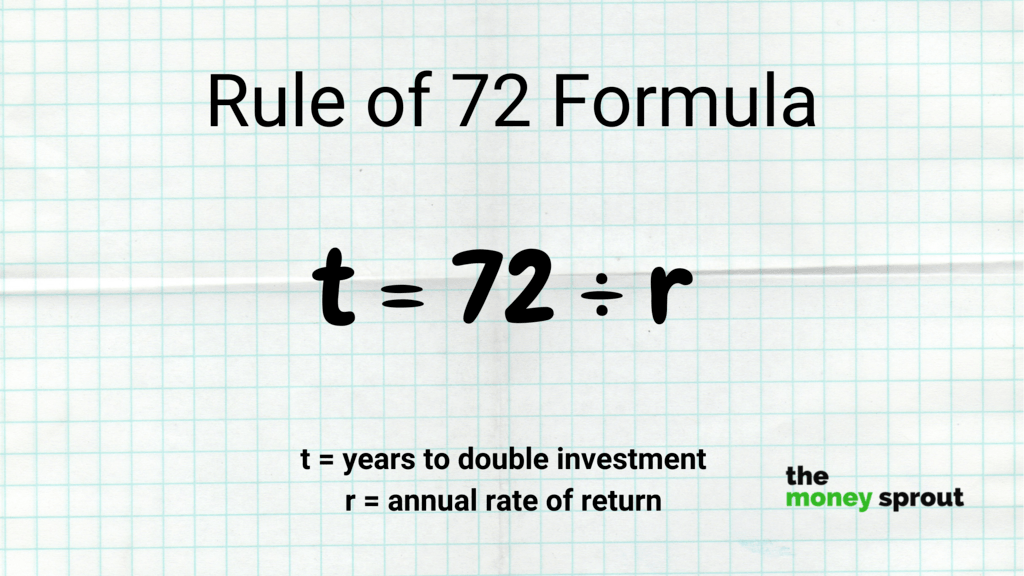

The rule of 72 is a simple shortcut calculation that can help estimate the number of years it will take for an investment to double. All that is required is to have a good estimate about the average annual returns of the investment.

The formula for the rule of 72 is actually very simple … you divide the rate of return by 72 to get the number of years.

years to double = 72 ÷ annual rate of return

Now if we take our example and plug in that 8.4% average annual return … we get 8.6 years.

8.6 Years to Double = 72 ÷ 8.4% average return

What does this mean?

Well … we have estimated that an investment in FSKAX today should likely double between years 8 and 9. This requires no new investments at all!

Index Fund Doubles Every 8 to 9 Years

Like I said many times before … these are just some back of the envelope calculations. However, based on conservative estimates of past performance, our low cost index fund should double every 8 to 9 years.

Let’s assume you have a balance in your IRA (or similar retirement account) of $250,000. You are still young … so you can weather most recessions and have the balance all in the Fidelity® Total Market Index Fund … or Vanguard equivalent.

How long will it take our investment to double … assuming we average 8.4% annual returns?

Without any additional investments … we could estimate your portfolio hitting $500,000 in 8.6 years. Or conservatively … let’s say 9 years to let it compound and double.

Working out the returns would look something like this –

Beginning Balance (Year 0) = $250,000

- $271,000.00 balance after year 1

- $293,764.00 balance after year 2

- $318,440.20 balance after year 3

- $345,189.15 balance after year 4

- $374,185.04 balance after year 5

- $405,616.58 balance after year 6

- $439,688.38 balance after year 7

- $476,622.20 balance after year 8

- $516,658.46 balance after year 9

The numbers don’t lie … sometime between the end of year 8 and 9 … our portfolio passed $500,000!

Just like our 8.6 year estimate!

And just like that … we have a retirement portfolio of a half a million dollars.

FI Number

There is really nothing special about the rule of 72 to be honest. It is just another way to look at compounding interest.

Like the calculated yearly balances above … the rule of 72 formula gives us a short cut to get to when the investment would double.

This is a great way (by the way) to try and estimate when you could hit your FI Number.

For a minute … let us assume your FI Number is $1,000,000.

What does that mean?

Well the 4% Rule (another calculation) says that if you can project your annual expenses and multiple by 25 … it will give you your FI Number.

I won’t get into those details in this post, but you can read more about it here.

Let’s say you estimated your annual expenses in retirement will be $40,000.

So your FI Number will be 25 times that amount … OR $1 million ($40,000 x 25).

Now we know we need $1,000,000 to retire … so let’s use our rule of 72 calculation to figure out when that is possible.

Remember … we doubled our $250,000 investment (without any new money invested) in about 8.6 years.

Guess what? We can take that $500,000+ balance at the end of year 9 … and estimate it will take another 9 years (or less) to double again. In this case, that is our $1,000,000 FI Number!

Here is a continuation of our example –

Beginning Balance (Year 9) = $516,658.46

- $560,057.77 balance after year 10

- $607,102.63 balance after year 11

- $658,099.25 balance after year 12

- $713,379.59 balance after year 13

- $773,303.47 balance after year 14

- $838,260.96 balance after year 15

- $908,674.88 balance after year 16

- $985,003.57 balance after year 17

- $1,067,743.87 balance after year 18

So in a little less than 18 years, which may seem like a long time (but really isn’t) … we took a $250,000 investment and turned it into $1 million!

And the best part is we didn’t add any additional funds (which we probably would have).

We didn’t move in and out of the market either … or worry about our portfolio.

Instead we sat back and spent time on things we enjoy … all while our investments were working hard building wealth for us!