This post may contain affiliate links. Please read our disclosure for more info.

The rule of 72 formula is a great way to illustrate how compounding interest can grow your investments.

I am a firm believer that everyone should be leveraging the power of compounding interest in order to grow their wealth. Even if you were to invest $25 a month … the power of a compounding investment is just too good to pass up.

One of the ways to quickly show this power is to use the rule of 72 on your investment portfolio.

Personally, I use it every month when I am analyzing my portfolio and it helps me stay on track with our investment goals.

Today I would like to share the details of using the rule of 72 formula.

Rule of 72 Definition

The rule of 72 is a simple shortcut calculation that can help estimate the number of years it will take for an investment to double.

All that is required to run the calculation is the annual rate of return for an investment.

Obviously, nobody will know the actual rate of return in the future … so you will need to estimate.

Required – average rate of return

Many investors use this formula to calculate how long it will take for their investment to double with a given rate of return.

Personally, I prefer to use it for our dividend portfolio. I like to calculate out how long it will take for our dividend income to double … using our average growth rate.

One important item to note – this calculation factors in compounding interest … which makes it possible to double your investment rather quickly.

Also, this estimate works very well for annual interest rates between 6% and 10%. The numbers get skewed a bit above or below those interest rates.

Here are a few good places to find more information about the rule of 72 –

- What is the Rule of 72? – by Investopedia

- The Rule of 72 – by Dividend Growth Investor

- Rule of 72 – on Wikipedia

Remember that this calculation is a “rule of thumb”, as nothing is guaranteed. It is only as accurate as your annual rate of return estimate.

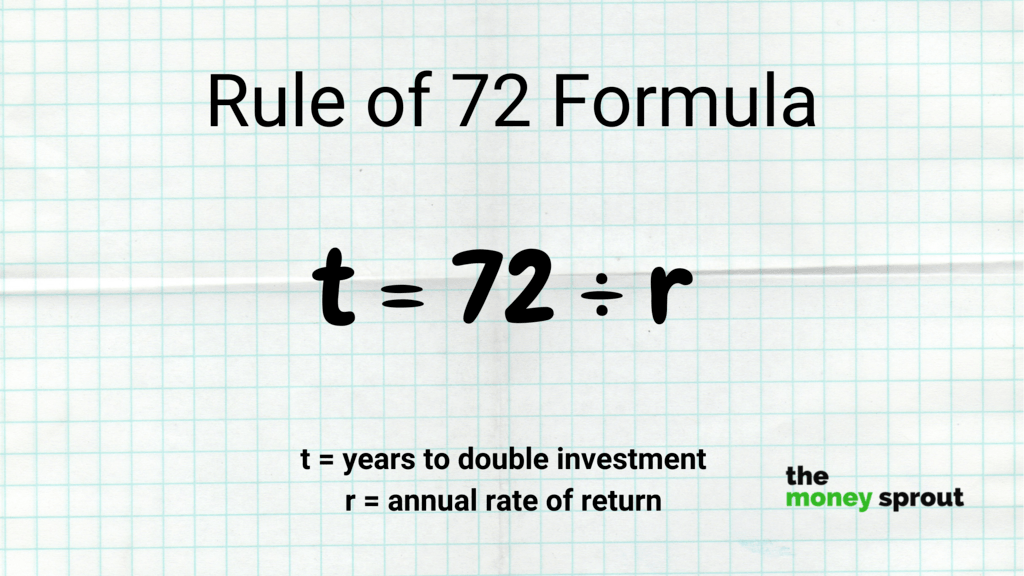

Rule of 72 Formula

The formula for the rule of 72 is actually very simple … you divide the rate of return by 72 to get the number of years.

Remember that the number of years represents how long it would take for your investment to double … assuming your average rate of return is accurate.

The rule of 72 formula looks like this –

years required to double investment = 72 ÷ annual rate of return

Let’s take a quick look at how this might work for a typical investment.

You may have an investment that earns 8% on average in a low cost index fund in your retirement account.

As an interested investor looking to build your retirement savings … you may be curious at how long it will take for your investment to double. This formula assumes you will no longer add any new money to the investment … which hopefully is not the case.

Our calculation would look like this –

9 Years to Double = 72 ÷ 8% average return

If you had a balance on year 1 in your retirement account of $100,000 … that investment would grow to $200,000 after 9 years at an 8% return.

Next, let’s take a more detailed look at the numbers from this example.

Rule of 72 Example

As I have mentioned, the rule of 72 formula is easy to understand. However, I like to see the actual numbers … I’m a nerd, I know.

So let’s take our example from above (the $100,000 retirement portfolio) and show how this works.

We start off with a balance of $100,000 in our retirement account and will earn 8% annual return every year. Yes … this could never happen in real life, but this is just a rule of thumb calculation.

Our investment growth would look something like this, up through year 9 when we double our initial investment (almost) –

- Year 0 – $100,000

- Year 1 – $108,000

- Year 2 – $116,640

- Year 3 – $125,971

- Year 4 – $136,049

- Year 5 – $146,933

- Year 6 – $158,687

- Year 7 – $171,382

- Year 8 – $185,093

- Year 9 – $199,900

- Year 10 – $215,892

Look at the growth of the portfolio over the 9+ years without any new investments! Yes … this is compounding interest working hard for you.

Also notice that we don’t actually hit $200,000 on year 9 … but rather soon after (which is why I showed year 10).

Remember that the rule of 72 isn’t exact, but rather an easy way to estimate approximately how long it will take for an investment to double.

Now doubling your investment is great … but I am a dividend investor trying to build cash flow. Will the rule of 72 work for dividend income too?

Rule of 72 for Dividend Investing

The rule of 72 works great for calculating how long it will take for your dividend income to double.

I use it every month for fun to track where we our on meeting our goals for future dividend income.

In order to run my calculation, I need to figure out a few things – (1) our starting dividend income, and (2) the average rate of increase per year.

We have a goal to grow our dividend income annually by a minimum of 9%.

This dividend growth comes from 3 different sources – new investments, dividend increases, and reinvested dividends.

After over a decade of investing in dividend stocks … I feel very comfortable being able to grow our dividend income by 9% each year … but hopefully more.

Let’s take a look at a real-life example of how this would work. We will start off with the actual dividend income we earned in 2020 … which was $3,886.97.

At 9% annual growth … I can expect our dividend income to double every 8 years –

8 Years to Double = 72 ÷ 9% average growth

Our numbers would look something like this –

- 2020 – $3,886.97

- 2021 – $4,236.80

- 2022 – $4,618.11

- 2023 – $5,033.74

- 2024 – $5,486.78

- 2025 – $5,980.59

- 2026 – $6,518.84

- 2027 – $7,105.53

- 2028 – $7,745.03

And just like that … by year 8 (or 2028) our dividend income will have doubled (or very close)!

In reality … we will be growing our dividend income by more than 9%, so the numbers should be much higher.

Using the Rule of 72

Using the rule of 72 can be a fun way to quickly calculate how compound interest can grow your portfolio … or in some cases your dividend income.

The results of the formula should be considered more of a “rule of thumb” of how fast your investments can grow. Since there are no guarantees on future growth rates, we can only make a best guess.

I like to use the rule of 72 to help estimate our future dividend income at the end of every month using our forward dividend income numbers. It helps to keep me motivated and on track with our long term investment goals.

Do you use the rule of 72 in any of your investment projections? Or are there other formulas or calculations you like to use for estimating your portfolio growth or dividend income?