This post may contain affiliate links. Please read our disclosure for more info.

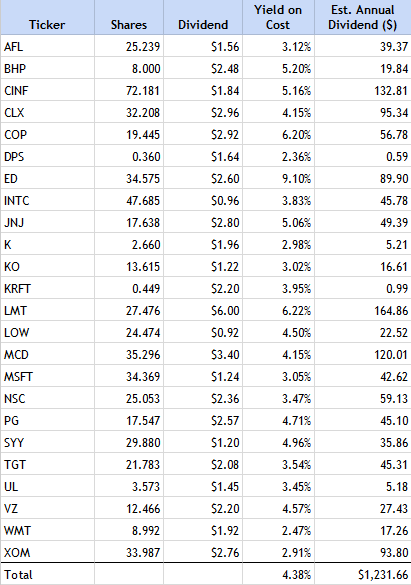

At the time of this writing, I am set to earn $1,230 in annual dividend income. That is assuming the 12 months started today and not at the beginning of the calendar year.

The projected $1,230 in annual dividends is nowhere near my long term goals. However, it is a 27% increase from my dividend income last year ($967).

My goal for this calendar year is to earn a lot more than my projected dividend amount. I actually have a goal to earn $1,500 in dividends this calendar year.

My 12 month forward dividend income calculation (which I like to call it) also assumes I will not sell any of the shares I currently own in the Money Sprout Index. In addition, the companies in my portfolio cannot make any dividend cuts in the next year or this number will drop.

The goal is to actually own companies that raise their dividend every year, which compounds the growth.

So what is the difference between actual dividend income earned and your 12 month forward dividend income?

Actual Dividend Income vs. 12 Month Forward Dividend Income

This may be a little confusing to the new investor but there is a difference between your actual annual dividend income versus 12 month forward dividend income.

The actual dividend income is the amount you have earned in a calendar year. So for the Money Sprout Index, it earned $967.12 in dividend income for 2014. That is the amount of cold hard cash that was paid back to me for owning shares in over 20 stocks.

On the other hand, my projected dividend income at the end of 2014 was $1,076.52 – over $100 higher than actual dividends received. Since I had invested thousands of dollars throughout the year, my projected dividend income is always increasing.

Note – remember that the 12 month dividend income starts on the date you run the calculation, not the first day of the calendar year.

Reporting actual dividends is fun and I do so on a monthly and annual basis on my dividend results page. However, reporting on the 12 month forward dividend income is what motivates me.

So Why Track Future Dividend Income?

I like to track the 12 month forward dividend income for the Money Sprout Index. For the most part, I am confident that the stocks I hold in my portfolio will not be cutting or lowering their dividends. After all, I follow an 8 step process every time I look to buy a dividend stock and feel very strongly about my decisions.

Since I feel confident enough in my investment choices, I am able to project my future dividends for the next year. I cannot stress how motivating this simple calculation is to me.

Any time a company increases their dividends, I see a bump in my future dividend total.

Every time I reinvest a dividend payment back into more shares of stock through DRiP, my future dividends increase.

When I purchase new shares of stock each month, there is another increase.

It is so motivating to see this number keep ticking upwards. Of course, I would love for it to move faster, but any growth is an increase over the prior year. It is all about building this income stream month by month and share by share.

How to Calculate 12 Month Forward Dividends?

I own shares of stock in several different platforms – Robinhood, LOYAL3, Fidelity, Computershare, and even ShareBuilder. Fortunately, I track all of my holdings in a spreadsheet that gets updated monthly.

Well – actually it gets updated a couple times a week because I am all about tracking my dividend income right now!

The first piece of information you need to know is how many shares of stock you currently own. It is a good idea to track this information in a spreadsheet or a software application like Personal Capital – especially if you have shares in multiple accounts like me. You will need to know the exact number of shares of each stock you own.

For example, from the chart above, you can tell that (at the time of this writing) I currently own 72.181 shares of CINF (Cincinnati Financial). As you can see, I track my fractional shares of stock since I purchase them every month through DRiP and LOYAL3 transactions.

Once you have the number of shares that you own, the next step is to locate the current dividend yield for each company. I tend to use Yahoo! Finance, but there are several places you can pull this information. You can pull it from the The DRiP Investing Resource Center, your online stock broker, or even the company’s shareholder site.

Note – Make sure you are pulling the most recent dividend information. Also be sure to pull the annual dividend amount (not the most recent quarterly amount).

So for example, Cincinnati Financial has a current annual dividend of $1.84 (shown in the chart above). As with years past, I am counting on this company to continue to raise their annual dividend – which will increase my 12 month forward dividend amount.

Tip – I prefer to update my dividends in a spreadsheet so that everything is setup to update if I add shares or if the dividend amount increases.

The next step is to multiply the number of current shares times the annual dividend. In our Cincinnati Financial example, I am currently projected to earn $131.82 in future annual dividends. I can’t wait to look back at this calculation a year from now and see even more growth!

72.181 shares (CINF) X $1.84 = $131.82

The final step (once you have calculated each of your stocks) is to add up all of the individual dividend amounts. In my chart above, I currently own 24 stocks in the Money Sprout Index that is set to pay $1,231.66 in dividends over the next 12 months!

Final Thoughts

There is no way to guarantee that I will actually earn $1,230 over the course of the next 12 months. I am only making a projected estimate of what my dividends would look like over the next 12 months. Nothing is guaranteed.

However, I feel very strongly about the stocks that I own. Because I am only selecting the best blue chip stocks available, the chances are good I will not only earn at least $1,230 but likely much more with dividend increases.

Having a diversified portfolio of 24 stocks will also help to maintain this number. If one company were to cut their dividend, then I would likely have 23 other companies helping to limit the loses.

I look forward to updating my 12 month forward dividend amount each month. It has motivated me to stick to my goals and continue to build my portfolio.

Do you track your 12 month forward dividends? How do you track this information and keep it up to date? Do you find the same motivation as me of updating your forward dividends?

The question that I have is – why? I do not track it because unless I am relying on that money (and I am decade(s) away from turning on the portfolio as a viable income stream) then tracking it does absolutely nothing.

What is the benefit? Just to make sure you are on the right track?