This post may contain affiliate links. Please read our disclosure for more info.

Over the past 12 months, our dividend income results have exploded.

We set a new record for annual dividend income earned, despite a global pandemic.

Our new investments into the dividend portfolio were the highest we ever put in. Almost every company we own (except for one) managed to raise their dividends in 2021. And we continued to reinvest every dollar earned back into the portfolio.

These events have allowed us to leverage the power of compounding growth in our dividend income portfolio.

We were able to increase our dividend income by almost 50% from the previous year, and we took the opportunity to invest a lot of new dollars.

It will take some time, but these new investments (along with reinvesting all of our dividends) will eventually compound and grow like crazy!

Let’s take a look at some of the highlights of our dividend income portfolio in 2021.

Dividend Income Portfolio

We currently own 40 dividend paying stocks in our portfolio (December 2021).

In addition, we own 2 dividend paying ETFs which include – VTI and VNQ.

All of the stocks and ETFs that we report on are included in a joint taxable brokerage account at Fidelity.

Note – in the past we used a couple different brokerage accounts (including Robinhood & M1 Finance), but consolidated them into our favorite. I know that Robinhood has become very popular over the past couple of years (and I had promoted them). However, there are several reasons we closed our Robinhood account back in 2020.

We did close out of a few stocks and ETF’s in our dividend income portfolio last year. The most notables were AT&T (T) and CVS Health (CVS).

There were no new dividend paying stocks added to our portfolio last year … for the first time in a while. We are trying to focus on the best of the best now and consolidate a bit.

All of the income stocks that we own in our portfolio raised their dividends in 2021 except the following companies –

- Omega Healthcare (OHI)

Finally, a few other companies we owned who did not raise dividends back in 2020 came through in 2021 with increases. These include –

- Caterpillar (CAT)

- Norfolk Southern (NSC)

- SYSCO (SYY)

Now let’s take a look at our dividend income results for last year.

2021 Dividend Income Results

Last year, my wife and I recorded our highest dividend income earned so far.

Since we didn’t see any dividend cuts and we continued to invest throughout the year, it was no surprise we would break our record from last year (2020).

Based on our investment philosophy, we should never see a decrease in annual dividend income. Even if we never invest another penny, our dividend income should grow each year.

In total, we earned $5,818.98 in dividends paid out to our taxable portfolio last year.

This was an increase of $1,932.01 since last year. That is an amazing 49.7% increase compared to 2020.

As long as we continue to grow our dividend income each year by over 9% … we will hit our long term dividend income goal. More on this further in the article when I discuss the Rule of 72.

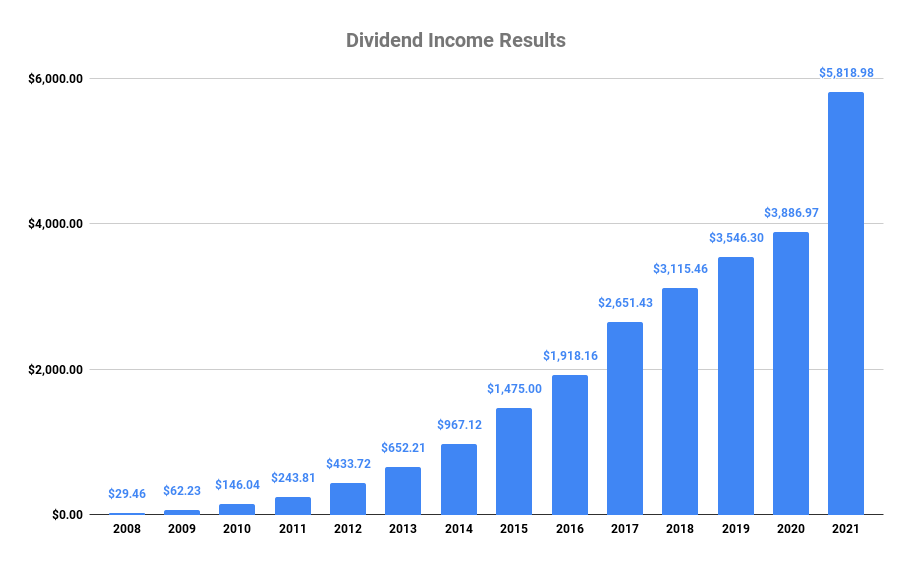

Speaking of growth, look at our dividend income over the past 14 years –

As you can see, we have steadily grown our dividend income each year since starting out in 2008. We expect to see similar growth in the future as long as we continue to invest new capital into the market.

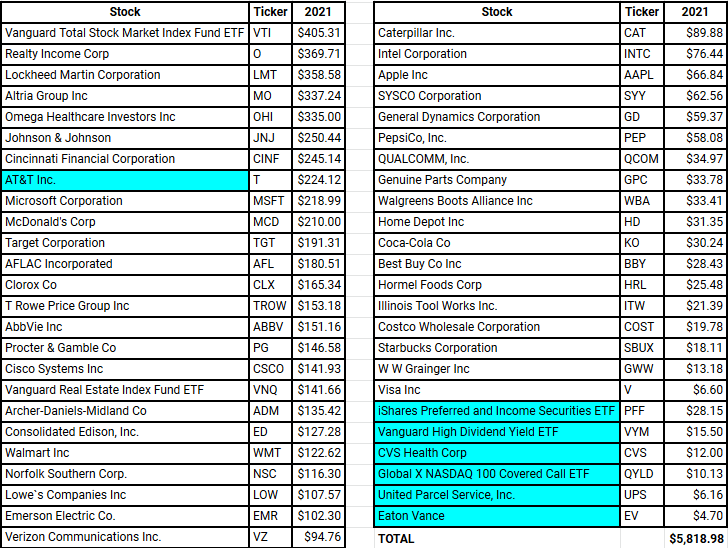

Here is a breakdown of all the stocks and ETFs we earned a dividend from last year.

Any company highlighted in blue represents a stock we sold during 2021 and no longer own.

Looking ahead in 2021, we are going to focus on high dividend growth stocks. These are companies with double digit dividend growth but likely have very low yield.

Growing Future Dividend Income

One of my favorite things about reporting our dividend income each month is looking at our future dividend income.

I certainly get excited reporting our past dividend income results, but the real fun is looking to the future … which looks very bright.

Based on our 12-month forward dividend calculation, we will earn approximately $6,632.04 in dividends during 2022.

That is a 53.05% increase of future dividend income compared to the start of 2021!

One important thing to note … this calculation doesn’t include any future reimbursement of dividend income back into more stocks.

Nor does it include any new investment dollars or dividend increases made by the companies in which we own shares.

There are only two things that need to happen in order for us to earn this amount in dividend income –

- we don’t sell any of our stocks in the portfolio

- companies we own don’t cut or lower their dividend

None of the companies we own cut or reduced their dividends in 2021 and it is doubtful that will happen in 2022. If a company were to make a dividend cut, then we’d likely sell our position and use the funds to purchase a different dividend growth stock.

Note – We recently sold all of our AT&T (T) shares in the fall of 2021 because of a future dividend cut.

Based on all these factors, I’d predict we will earn a minimum of $6,632.04 in dividends this year.

Honestly, I would expect it to be larger because this estimate doesn’t take into account the following –

- dividend increases

- new investments

- reinvested dividends

Based on these 3 factors, I have set a goal for us to earn $7,200 of dividend income in 2022!

Rule of 72 – How Fast Will Our Income Double?

At the beginning of 2018, I started tracking the rule of 72 projections for future dividend income in our taxable brokerage accounts.

The Rule of 72 is a calculation that estimates how often your investments will double. While most investors use this to calculate the value of their portfolio, I like to use it to project our future dividend income.

Using the rule of 72, I have calculated (conservatively) that our dividend income will double every 8 years … without doing anything. A more bullish estimate puts it at every 6 or 7 years … but I like to plan in a buffer.

Based on this rule, I can calculate out how our dividend income could grow (and double) based on our future annual dividend income number of $6,632.04 … that would be earned on December 31, 2022.

Take a look at how our income could double overtime –

- 12/31/2022 – Annual Dividend Income = $6,632.04

- 12/31/2030 – Annual Dividend Income = $13,264.08

- 12/31/2038 – Annual Dividend Income = $26,528.15

- 12/31/2047 – Annual Dividend Income = $53,056.30

Our updated figures tell us we should be earning very close to $53,000 per year in dividend income by the end of 2047.

Keep in mind, this is more of a fun what-if type of scenario. I believe we have figured conservatively … and our income should grow at a faster rate. And it should be fun to watch this number grow every month when we post results.

Wrapping Up 2021

We finished the year with a portfolio of 40 dividend stocks, and 2 ETFs.

Despite a lot of market volatility, global pandemic, inflation, etc. … our dividend income stream held up very nicely.

This was our highest dividend income year ever. We earned $5,818.98 last year … a 49.7% increase compared to 2020!

Based on our future annual dividend income projections … we expect to earn at least $6,632.04 in 2022. However with additional investments and expected company dividend increases … I fully expect to top the $7,200 dividend income total.

I am really excited about growth beyond 2022 too!

Just look at the estimates from our Rule of 72 projections – in about 8 years we should be earning just over $13,000 per year in dividend income. That is an average of over $1,000 per month in dividend income … which blows my mind!

Those calculations also are very conservative … which would mean no new money ever invested again. No company dividend increases.

I look forward to a healthy and successful 2022!

How did your 2021 dividend income results turn out?