This post may contain affiliate links. Please read our disclosure for more info.

This is a guest contribution by Josh Arnold of Sure Dividend. Sure Dividend helps investors build high quality income portfolios for retirement.

High-yielding dividend stocks are useful for a variety of investors. While there is no specified cutoff for what represents “high-yield” and what doesn’t, we define high-yield dividend stocks as those with yields in excess of 4%.

High income stocks can provide retirees with high levels of current income, or the ability to reinvest dividends for those still working their way towards retirement. We believe the best of these high-yield stocks are undervalued, have significant internal earnings capabilities, and have a sustainable dividend with payout growth capacity. Read on to see which three high-yield stocks are our favorites right now.

AT&T (T)

AT&T is a leading provider of telecommunications and digital entertainment services globally, but is focused in the US. The company enjoys a diversified revenue stream from wireless, TV and digital entertainment services that collectively afford it about $170 billion in annual revenue. The stock trades with a market capitalization of $215 billion, which is down roughly 30% from its recent peak.

AT&T’s Q3 earnings report was released on 10/24/18 and results were largely in line with our expectations. Total revenue increased 15% year-over-year thanks mostly to the addition of Time Warner, which was partially offset by some weakness in the Latin America business. The ex-Time Warner business saw some profitability improvements that helped drive earnings-per-share 22% higher against the comparable period. Importantly, free cash flow rose 16% year-over-year as operating margins rose 310bps.

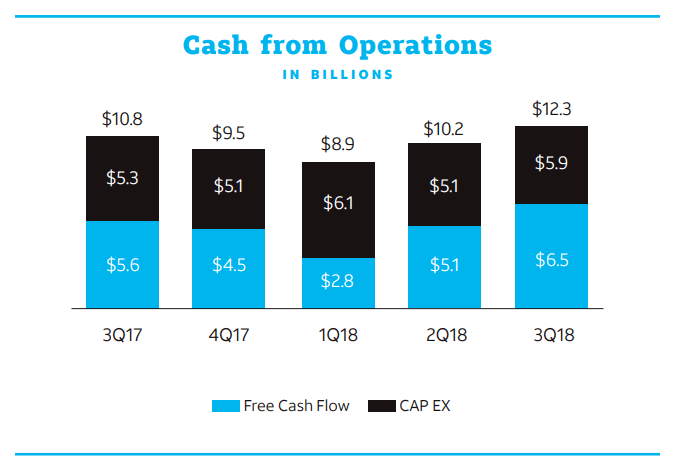

Source: Investor briefing, page 4

This chart from the company’s Q3 investor briefing shows how AT&T’s significant free cash flow is growing once more after a dip earlier in 2018. Trailing-twelve-months free cash flow is back up to $19 billion, which affords it the ability to have the financial flexibility to pay its outstanding dividend and fund future growth for the business.

The dividend costs just under $10 billion annually, which is just over half of the free cash flow the company has produced in the last twelve months. In other words, the dividend earns high marks for safety as it is very well covered by free cash flow. In addition, AT&T raises the payout each year, having recently extended its streak of dividend increases recently to an impressive 34 years, making it part of the desirable Dividend Aristocrats.

In total, we see AT&T producing in excess of 20% total returns annually in the years to come. Earnings growth should amount to 6% or so per year as the Time Warner business and profitability gains collectively fuel the next leg of earnings expansion, while the 6.9% yield and a high single digit tailwind from a rising valuation will help as well. We see AT&T as trading at just 65% of our fair value estimate today, so significant gains will accrue to shareholders should the stock return to more normalized levels. AT&T’s total return profile looks very attractive because it is balanced between earnings growth, yield and valuation.

AbbVie (ABBV)

AbbVie is a biotechnology company that is focused on developing and selling drugs for oncology, immunology and virology. The company used to be part of Abbott Laboratories (ABT) but was spun off in 2013. AbbVie has become a juggernaut in the biotech industry as its annual revenue is about $30 billion annually and its market capitalization is $134 billion.

The company reported Q3 earnings on 11/2/18 and results were characteristically very strong. Revenue increased almost 18% against the comparable period as Humira, the world’s most successful drug, generated a 9% increase in revenue to $5.1 billion. Imbruvica, which is used to treat cancers like lymphoma and leukemia, saw its revenue soar 41% year-over-year to nearly a billion dollars. The company’s total earnings-per-share rose 52% year-over-year to $2.14 and management raised its guidance to $7.91 at the midpoint.

Subsequent to the end of the quarter, management authorized a $5 billion increase to the share repurchase authorization, good for about 4% of the current float, which will help boost earnings-per-share via a lower float.

We see AbbVie producing roughly 10% earnings-per-share growth annually in the years to come thanks to its very successful products growing their revenues, and the operating leverage that will bring. Humira has been and continues to be the most successful drug in the world and its revenue stream is shielded through the early-2020s. However, even without the continued success of Humira, AbbVie is making other breakthroughs, such as with Imbruvica, that will fuel the next leg of growth.

In addition, variable costs are extremely low in the biotech industry, meaning that revenue increases lead to outsized gains in margins. As AbbVie’s drugs continue to grow their revenue streams, the profitability of those revenues should continue to increase and thus, earnings-per-share should continue to grow more quickly than the top line.

AbbVie’s yield is a significant draw as well as the stock currently pays a ~5% yield. Given how young AbbVie is as a standalone company, that yield is enormous, but the company’s business model doesn’t require much cash reinvestment, so it is free to return it to shareholders in huge quantities. The current payout is just over half of the company’s total earnings, so it is very safe, and we expect it will continue to be raised at high rates for many years to come. Indeed, the payout is over five times what it was just five years ago as management has made it clear the dividend is a high priority.

In total, we expect AbbVie to produce at least mid-teens total returns for shareholders in the coming years. Earnings-per-share growth should approach 10% annually, while the dividend is good for 4.8% and the valuation should add a low single digit tailwind. We see fair value for AbbVie at $103, which is about 15% higher than it trades today. AbbVie offers tremendous earnings and dividend growth potential, in addition to a high current yield.

Altria (MO)

Our final stock in this list is Altria (MO), a company that has been in business since 1847. It is a dominant player in cigarettes with its Marlboro brand, but has also diversified over the years to heated tobacco, wine, vaping products and smokeless tobacco. Altria has a market capitalization of $93 billion and annual revenue approaching $20 billion.

Altria reported its Q3 earnings on 10/25/18 and results were roughly in-line with expectations. Revenue net of excise taxes increased 3.3% to about $5.3 billion, while earnings-per-share rose 20% from the year-ago period to $1.08 on an adjusted basis. The smokeable product segment, which is Altria’s core business, saw revenue increase 1% as price increases more than offset declining shipment volumes. Indeed, this has been the case for some time now as Altria’s customers that continue to smoke appear not to take price into consideration. Altria’s earnings-per-share growth in Q3 was due mostly to a lower tax rate and its sizable share repurchase program.

We see Altria producing robust 7% earnings-per-share growth annually in the coming years through a combination of pricing increases in its core cigarette business, but also some recent growth initiatives the company has undertaken. For example, Altria has made recent growth investments in Cronos, a global cannabinoid company, and leading e-vapor company JUUL. These transactions entailed investments of $1.8 billion and $12.8 billion, respectively, and represent Altria’s latest efforts to diversify its revenue streams away from declining cigarette volumes.

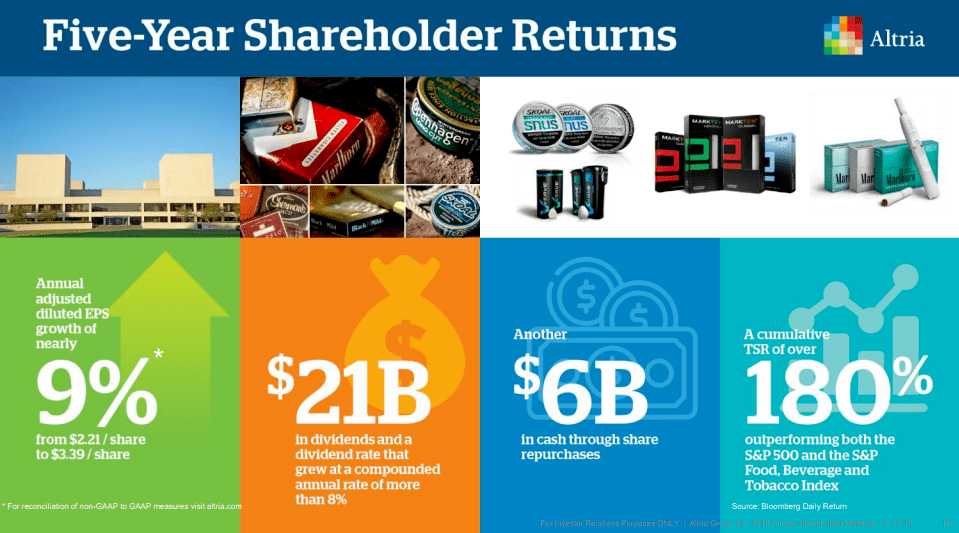

Source: Investor presentation, page 10

Altria has been an exceptional returner of capital to shareholders in recent years, as this slide details. Earnings-per-share growth continues while the company uses its ample free cash to pay a 6.5% dividend yield and buy back stock. The dividend is safe at this point despite the fact that it is roughly 80% of earnings. This is a normal payout ratio for Altria as its business has a low capital intensity, so it is free to return most of its earnings via dividends.

We see total returns in the mid-teens annually for Altria after the recent selloff in the stock, which has put it at just 76% of our projected fair value. That should provide a mid-single digit tailwind to returns, combined with 7% earnings growth and the 6.5% yield for a very attractive total return profile.

Final Thoughts

High-yielding stocks can help a variety of investors generate income and build wealth over the long-term. The stocks listed above represent the best high-yielding companies in our coverage universe as they all offer varying levels of value, growth and yield today. One important thing they all have in common, however, is that their high yields appear to be very safe and poised for future growth.

[divider style=’centered’]

John’s Comments – A special thanks to Josh Arnold at Sure Dividends to provide analysis on these top 3 high yield companies. My personal holdings including both AT&T (T) and Altria (MO) stock and are part of our dividend stock portfolio.

Thanks for sharing these 3 high yielding stocks. AT&T is certainly on my buy list, and I wouldn’t mind adding MO as well. It’s hard to find quality high yielding stocks like the 3 you covered. I agree that these are some of the safer long term options.