This post may contain affiliate links. Please read our disclosure for more info.

Time sure does seem to fly by. We are getting down to the end of 2016 and our dividend income keeps growing.

That is the thing I love about dividend income. As long as you are willing to put your money to work for you … it pays you back over and over.

We bought our first dividend stock over 8 years ago, back in 2008. Since that time we have gone from earning less than $100 a year in dividend income to averaging well over $100 a month now.

We still have a long way to go in building our dividend income portfolio, but I think we have built a solid foundation.

Here is our dividend income portfolio results for October, 2016 –

2016 October Dividend Income Results

October is always one of those “other” months it seems like when it comes to earning dividend income. The good news is that this past month still generated over $100 in passive income.

October is always one of those “other” months it seems like when it comes to earning dividend income. The good news is that this past month still generated over $100 in passive income.

When I write these dividend income articles, I like to compare our monthly results to the same time period in the past. This tends to be a great way to see how our overall portfolio is growing since we are usually comparing the same companies from years past.

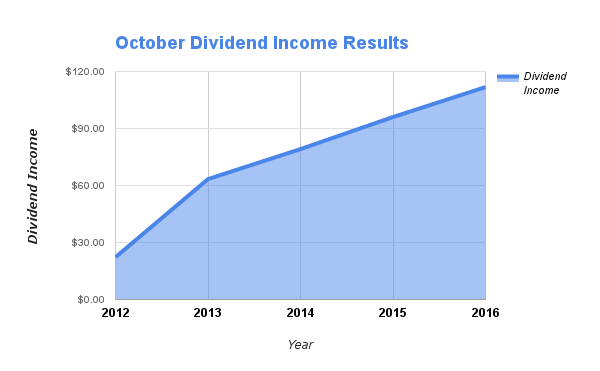

Look at the growth we have seen over the past several years based on October dividend numbers –

- October 2012 – $22.28

- October 2013 – $63.37

- October 2014 – $79.16

- October 2015 – $96.03

October 2016 Dividend Income – $111.78

We saw an increase of over 16% last month compared to October 2015! Just look at the growth compared to last year where we are up by over $15 in dividend income.

As long as these numbers continue to grow each year at a moderate rate, I know that we are building a solid and sustainable income stream.

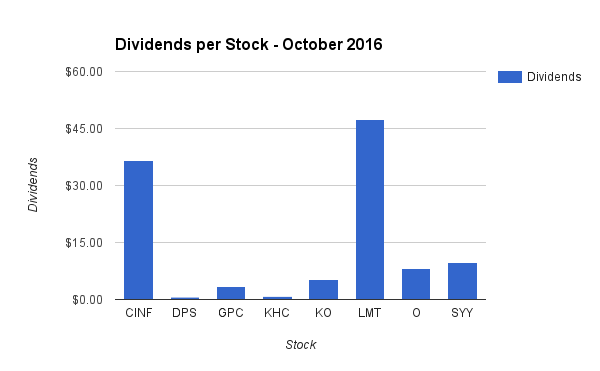

Here is the breakdown of dividend income (by stock) in October –

- Cincinnati Financial Corp (CINF) – $36.60

- Dr Pepper Snapple Group, Inc. (DPS) – $0.63

- Genuine Parts Company (GPC) – $3.29

- The Kraft Heinz Company (KHC) – $0.86

- The Coca-Cola Company (KO) – $5.35

- Lockheed Martin Corporation (LMT) – $47.29

- Realty Income Corporation (O) – $8.08

- Sysco Corporation (SYY) – $9.68

Note – All of the dividends we currently receive are reinvested into new shares of the same stock using DRiP – except those purchased through our LOYAL3 and Robinhood accounts.

New Capital Invested in October

Regardless of which direction the market is going, we have been dedicated to investing new money into dividend stocks. Here are the new investments we made in October –

- $301.26 lump sum investment in Archer Daniels Midland (ADM) – 7 shares

- $466.35 lump sum investment in Omega Healthcare Investors Inc (OHI) – 14 shares

Note – All of these investments were made through our Robinhood account … which means we did not pay any commissions or fees on these trades.

The total amount of new capital invested in October was – $767.61

Here are the new investment totals for the year –

- January Investments – $518.30

- February Investments – $527.49

- March Investments – $584.08

- April Investments – $500.00

- May Investments – $2,441.26

- June Investments – $1,142.25

- July Investments – $970.08

- August Investments – $0

- September Investments – $176.24

- October Investments – $767.61

New 2016 Investments – $7,627.31

12 Month Forward Dividend Income

I don’t always report our 12 month forward dividend income.

However, we recently set a goal to grow our forward annual dividend income to $3,000 by the end of next year (2017). We have given ourselves 14 months to accomplish this and believe we need to invest $20,000+ to make it happen.

So I have decided to start reporting these numbers again so we can get an idea of where we stand each month.

Here are our current and past results –

12 Month Forward Dividend Income

- October 2015 – $1,698.24

- October 2016 – $2,114.46

I wanted to compare last October’s results (2015) to this year to show how much we have grown. Our 12 month forward income grew by 24.5% this past year!

That is an increase of $416.22 in future dollars.

This projected dividend income number will grow from 3 different sources –

- Dividend Increases

- Reinvested Dividends

- New Investments

Note – The majority of the increases will come from new investments over the next 14 months.

Conclusion

The dividend income earned in October ($111.78) was up over 16% from the same time last year. This is another indication that our portfolio is constantly growing.

As I mentioned earlier – the growth is from the combination of dividend increases, reinvested dividends, and new investments.

To date, we have earned a total of $1,524.80 in dividend income for 2016. This is the first time that we have earned over $1,500 in dividends in a year. The good news is that we still have 2 solid months to add to our total!

At this rate, we would earn around $1,925 in annual dividend income this year.

Unfortunately our goal to earn $2,250 in dividend income during 2016 is out the window. Not saving and investing enough of our income has kept us from hitting this years target.

All is not lost though. Earning over $1,900 in dividends is a huge jump from $1,475 last year and still a solid number. It certainly would be awesome if we could squeak past $2,000 though!

How was your dividend income in October? What stocks are you buying in this market?

Full Disclosure – At the time of this writing, we owned shares in the following stocks noted in this post – ADM, CINF, DPS, GPC, KHC, KO, LMT, O, OHI, and SYY. The material above is not a recommendation to buy. Please do your own research on a company before deciding to invest.

I personally love the products of DPS but are you concerned by them being a soft drink only company (like KO)? Do they need to add some food/snacks (like PEP)?

@TheDividendLife – To be honest, I hadn’t thought about that. My DPS position is so small that I don’t pay much attention to it. And we are not adding any new shares.

Interesting question though …

Good job. As you keep adding and reinvesting those will grow and grow and grow. I did around 160 or so I’m already over last year so hopefully that trend continues where I pass the previous years in Sept and Oct for a few years would be nice but don’t know. Keep buying.

Thanks! $160 in October is great.

Keep up the great work.

Congrats on earning over $100 for the month. It’s a nice average to maintain and grow going forward. Looks like you are doing all the right things too as you are putting up nice double digit year over year gains. Though your annual goal is out of reach, the silver lining is that you are making more than the previous year total. Just goes to show the power of dividend growth.

Thanks! The double digit annual gains are awesome and yes the power of dividend growth is amazing.

Keep it up, you’ve got some great growth year over year going here! Breaking that $100 as an average is a sweet feeling. Our dividend income for October was pretty good, really looking forward to what Nov and Dec bring. As for stocks, not really sure, I think we’re looking at expanding our international holdings so probably just some diversified etfs.

Appreciate the comments. I am really looking forward to December. We are so close to having our first $300 month. Won’t get there yet, but will likely blow past it next March.

Thanks for stopping by.

Wow! Look at that growth history. As you are well aware it is easier to get from $100 to $200 then it was to get from $0 to $100!

Yes, it would be awesome to keep up that same growth history. I am hoping the jump from $200 to $500 is just a quick!

Thanks for stopping by.