This post may contain affiliate links. Please read our disclosure for more info.

It feels like 2017 is flying by! We are now halfway through the year, and the dividend income continues to pour in. And this past month … it really started to pour in as we set a new all time monthly record!

And on top of a record dividend income month … we also continued to build our portfolio foundation up by investing new money into the market. It was a big month for new investments, which will fuel our future growth and income.

Speaking of growing our portfolio … besides new investments, there are two additional ways we can build our future income that don’t take much work (or money).

First, we are able to grow our portfolio (and future income) by reinvested all of the dividends we earned … either through dividend reinvestment plans (DRiP) or through one off transactions in our Robinhood account.

Secondly, future growth is also helped through different company dividend increases, which we received 4 this past month. Getting these increases is awesome … because we didn’t have to do anything except hold onto our shares for the long term.

Overall, it was a great month and another step towards building and growing this sustainable income stream.

So … here is our dividend income portfolio results for June 2017 –

2017 June Dividend Income Summary

For the first time ever … we earned over $300 in dividend income for a month. And it wasn’t by just a little bit either. We earned an awesome $342.75 in dividends from stocks that we own during June.

For the first time ever … we earned over $300 in dividend income for a month. And it wasn’t by just a little bit either. We earned an awesome $342.75 in dividends from stocks that we own during June.

This sets a new all time record for monthly dividend income earnings for us! It shatters the record we set back in March (2017) by over $60.

Month by month, year by year … we continue to slowly grow this sustainable income stream.

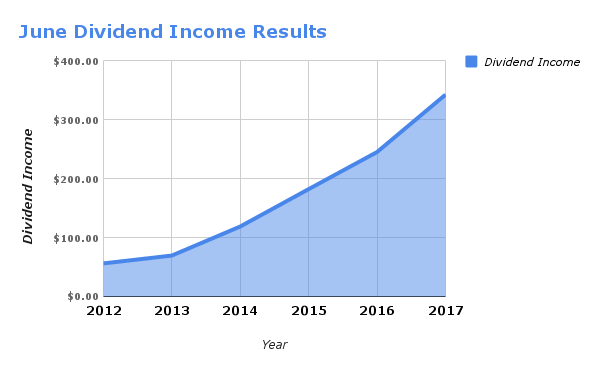

Just take a look at the growth we have seen over the past 6 years based on June dividend income results –

- June 2012 – $56.23

- June 2013 – $69.57

- June 2014 – $118.91

- June 2015 – $182.38

- June 2016 – $245.38

June 2017 Dividend Income – $342.75

We saw an increase of 39.7% last month compared to June 2016!

This latest increase shows all the new capital we have invested into the market over the past year is working very hard.

June 2017 Dividend Breakdown by Company

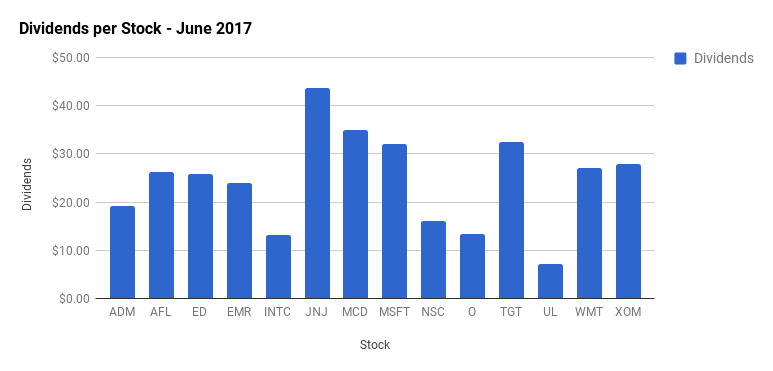

Overall, we had 14 stocks pay out a dividend in June. Solid dividend paying companies like Aflac, Johnson & Johnson, and McDonald’s gave our family a paycheck for not really doing much at all. You can’t really beat that!

Recent investments in Aflac (AFL), Archer Daniels Midland (ADM), and Target (TGT) over the past year are a big reason for these increases.

Here is the breakdown of dividend income (by stock) in June –

- Archer Daniels Midland (ADM) – $19.20

- Aflac Incorporated (AFL) – $26.23

- Consolidated Edison (ED) – $25.77

- Emerson Electric (EMR) – $24.00

- Intel Corp. (INTC) – $13.07

- Johnson & Johnson (JNJ) – $43.59

- McDonald’s Corp (MCD) – $34.93

- Microsoft Corp (MSFT) – $31.98

- Norfolk Southern Corp (NSC) – $16.09

- Realty Income Corp (O) – $13.29

- Target Corp (TGT) – $32.53

- Unilever (UL) – $7.18

- Wal-Mart Stores Inc (WMT) – $27.03

- Exxon Mobil Corp (XOM) – $27.86

Note – All of the dividends we currently receive are reinvested into new shares of the same stock using DRiP – except those purchased through our Robinhood account.

New Capital Invested in June

Over the past 9 months, we have been focused on growing our forward annual dividend income to $3,000 by the end of 2017. We set this goal last November (2016) and have been busy investing new money into dividend stocks ever since then.

The goal requires that we invest 20% to 25% of our income … which can be difficult during certain times of the year. That comes out to around $1,400+ per month.

As you can tell below, we have been up and down with these new investments. The good news is that the last two months (May & June), we have been meeting our goals. Plus in April, we had a big boost from investing most of our tax refund.

Here are the new investments we made in June –

- $50.00 investment in Cincinnati Financial Corp (CINF) – .70 shares

- $668.61 investment in Cisco Systems (CSCO) – 21 shares

- $401.00 investment in CVS Health Corp (CVS) – 5 shares

- $227.92 investment in Qualcomm (QCOM) – 4 shares

- $101.06 investment in Target (TGT) – 2 shares

Note – All of these investments were made through our Robinhood and transfer agent (CINF) accounts … which means we did not pay any commissions or fees on these trades.

The total amount of new capital invested in June was – $1,448.59

Here are the new investment totals since the start of 2017 –

- June 2017 Investments – $1,448.59

- May 2017 Investments – $1,232.63

- April 2017 Investments – $4,862.18

- March 2017 Investments – $988.23

- February 2017 Investments – $647.76

- January 2017 Investments – $600.42

New 2017 Investments – $9,779.81

Growing Our Dividend Income

The dividend income earned in June ($342.75) was up over almost 40% from the same time last year. That is truly incredible that we have grown our dividend income by that much over the past 12 months!

On top of the growth, for the first time ever we topped $300 in a month for dividend income. This is another little milestone that we hit and will help motivate us to keep building and growing our sustainable income stream.

All of the increases were from a combination of new investments made, dividend reinvestment’s, and company dividend increases.

Speaking on company dividend increases – we got several this past month – Lowe’s (LOW) 17.10%, Caterpillar (CAT) 1.30%, Realty Income (O) 0.24%, and Target (TGT) 3.30%.

Overall, those increases will boost our annual dividend income by $11.61! That is just awesome.

Our goal for 2017 is to earn $2,400 in dividend income.

We have earned a total of $1,206.23 in dividends for 2017 … which means we need to earn around $1,200 the remainder of the year. That is an average of $200 per month.

Unlike 2016, I think reaching our goal in 2017 will be challenging but within reach. Last year, we set an unrealistic goal and didn’t come close to reaching it.

As long as we keep up with our new investments, I think reaching our 2017 dividend income goals can be attained. And if all goes well, we will be on our way to reaching a goal of $3,000 in dividend income for 2018!

How was your dividend income in June?

Full Disclosure – At the time of this writing, we owned shares in the following stocks noted in this post – ADM, AFL, CINF, CSCO, CVS, ED, EMR, INTC, JNJ, MCD, MSFT, NCS, O, QCOM, TGT, UL, WMT, and XOM. The material above is not a recommendation to buy. Please do your own research on a company before deciding to invest.

Good job. I hit 300 for the first time last December totally unexpected as i was hoping for around 250. I skipped the 200 dollar mark for the third month. Which really helps out.

You have lots of solid companies paying you which is awesome.

We share MsFt O and Walmart. Hopefully next year at this time we are both either over or knocking on 500 for the month

Keep it up.

@ Doug – congrats on hitting $300 last December! I hear ya on the $500 next year – that is our goal. Best of luck.

Don’t remind me about how fast 2017 is flying by. Congrats on hitting a record for passive income in June. You brought in a nice sum that can already pay for some regular monthly bills. Looks like have have about half a dozen names in common paying us. Your list of dividend payers looks very solid. Thanks for sharing.

@ DivHut – Thanks! You got that right about being able to pay some monthly bills with the dividend income earned last month. Looking forward to the day when I can pay all of them!