This post may contain affiliate links. Please read our disclosure for more info.

Buying and holding blue chip dividend stocks has been an investment strategy my wife and I have been using for over the past decade.

Most of the time ... this strategy is boring to other investors. The companies that we invest in (with the exception of a few) are not high growth stocks that will double your return in a year.

Instead, the companies we choose to invest in have been around for a long time and experienced many market upturns and downturns.

Think of companies like McDonald's, Clorox, and Johnson & Johnson.

Everyone probably has heard of these companies. But do they really excite a lot of investors these days like a Tesla or Facebook might?

I doubt it.

Today I would like to discuss an investment we made over 11 years ago in a dividend stock. The shares we purchased have grown and compounded over that time ... with no real work on our part.

This strategy is the lazy way to grow a dividend income stream.

Let's start by looking at one of best tools investors have available to build their income - compounding dividends.

What are Compounding Dividends?

One of the keys to building wealth is using compounding interest to your advantage.

For example, my wife and I have been building a compounding dividend investment portfolio for over the past 10 years. For the most part, the income earned from our portfolio of stocks is sustainable and will grow over time.

How do blue chip stocks produce compounding dividend payments year after year?

The first way for investors to compound their dividend income is simply done by reinvesting your dividends back into additional shares of stock.

Say you earn $10 every quarter on a dividend stock. The investor with a focus on growing this income stream would simply reinvest those dividends ($40 for the year) for the time being into new stock.

This would allow new shares to be purchased with no out of pocket money to the investor ... that can grow and compound even more dividend income.

The second opportunity to earn compounding dividends is through annual dividend increases made by the companies that you own.

There is a whole method for narrowing down and selecting these types of companies to own ... which we won't get into today. But many of the boring blue chip companies that have been around for a long time are perfect opportunities to earn compounding dividends.

The combination of both reinvesting dividends and annual increases made by companies offers a great opportunity to build wealth over time.

Next I'd like to share one of my success stories of how to grow a dividend income stream ... the lazy way!

How to Grow a Dividend Income Stream

Think of the following example as a case study on how to grow a long term dividend income stream.

The following dividend growth example details the history of investing in one dividend stock over 11 years ago.

The first blue chip dividend stock my wife and I purchased was Consolidated Edison

(ticker symbol - ED) ... which we still own today.

Here is a brief history of this income stream and how it has grown (with more details provided further below) -

The scenario detailed below are real numbers taken from our investment in Consolidated Edison stock. This is only a small percentage of our annual dividend income ... approximately 3.5%.

I have broken down the steps we took (or rather lack of steps) in order to build this passive income stream.

Honestly, it is really a very simple process ... provided you are patient.

1 - Buy 25 Shares of Consolidated Edison (ED)

Back in the summer of 2008, we purchased 25 shares of Consolidated Edison (ED) stock for $39.10 per share.

This was the first time that my wife and I purchased a stock with the goal of earning dividend income. Looking back over the past 11+ years since our purchase, we probably couldn't have asked for a better outcome.

Sure ... there could have been better investment options that would have had higher returns ... but we could have done a lot worse too.

These shares of Consolidated Edison have served as part of the foundation of our dividend income portfolio. And unless the company decides to cut the dividend in the future, our plans are to never sell these shares.

Here is a look back at our initial purchase -

Now let's look at how we have paid ourselves back from this investment.

2 - Reinvest Dividend Income

When Consolidated Edison paid our most recent dividend in December 2019, we basically paid off our initial investment.

What do I mean? After getting 46 quarterly dividend payments over 11.5 years, our total dividend income ($985.57) exceeded our initial purchase price ($977.50).

Yes ... it took over a decade to get there. But we were patient and let this investment grow ... and compound.

How did our investment compound? Every one of those 46 dividend payments over the years was reinvested through DRiP back into more fractional shares of ED.

Over that time, we managed to buy an additional 16.053 shares of Consolidated Edison stock ... all by reinvesting the quarterly dividends.

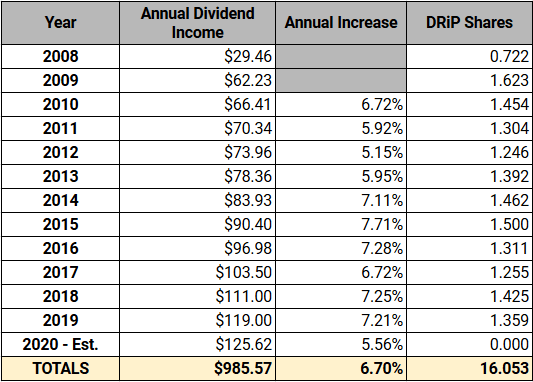

Not only did our investment compound by reinvesting dividends, but the company also managed to increase their dividends annually. The combination of these two (DRiP & dividend increases) helped us get to a 10 Year Average Dividend Growth Rate of 6.70%.

What does that mean? On average over the past 10 years, our dividend income from shares of this company have increased by 6.70%.

I'm not sure about you ... but my employer has never given me a recurring annual raise that high for a decade straight!

Here is a quick snapshot of how we grew our Consolidated Edison dividend income investment up through December 2019.

So as you can see from the numbers, reinvesting our dividends back into fractional shares helped to compound our income.

But keep in mind ... there is another key ingredient that helped us get to that 6.70% growth rate - which is annual dividend increases.

3 - Wait for Annual Dividend Increases

Just like clockwork, a few weeks ago, Consolidated Edison announced their annual dividend increase.

Remember ... this is one-half of what makes up our dividend compounding long term strategy. The other half of the strategy comes from reinvesting the dividends back into additional shares of stock.

The most recent increase (2020) was for an annualized dividend of $3.06 per 1 share of stock. This is a 3.38% increase, compared to the previous years (2019) payment of $2.96.

As a result of this increase, our 2020 dividend income we will receive from our total number of ED shares is $125.62.

For comparison, in 2019 we earned a total of $119.00 from our shares of ED.

Below you will find a breakdown of the annual dividend income we have earned between 2008 - 2019 (or 46 quarterly payments).

Note - The 2020 results are not included in the totals and are just an estimate for the year at the time of this writing.

Note - Starting in 2020, I have stopped the automatic DRiP on all of our stocks we own. The goal now is to pool funds together each month to purchase new stocks for the portfolio or add to existing positions. Regardless ... we are still in the accumulation phase of building our portfolio and will continue to reinvest 100% of dividend income earned.

To provide a little context on how the Consolidated Edison dividend grows on average, we've included the dividend growth rate (DGR) of the company for several intervals below.

Why is the dividend growth rate of a stock important for investors?

It let's us know on average how much the company is growing it's dividend annually. This means growth that takes no reinvestment or new dollars from the investor.

Where do we go from here?

Starting in 2020, we made a switch in how the majority of our dividends are reinvested.

Instead of setting up DRiP on our dividends, we are opting to have them come into our brokerage account as cash. Then collectively each month, we will invest those dividends into shares of stock.

What we purchase will depend on our current analysis of dividend stocks and the overall market conditions.

The only exception to this change will be stocks held in our M1 Finance account. Anytime our cash balance rises above $10, the account will automatically reinvest the dividends into a collection of stocks.

All other dividend stocks held in our Fidelity account will not use DRiP or automatic investing. This includes our dividends from Consolidated Edison (ED).

In the future we may choose to purchase more shares of ED using this new method of dividend reinvestment ... but it will depend on the metrics of the company compared to others.

Over the past 11+ years, using DRiP has helped us build a solid foundation of dividend stocks ... including Consolidated Edison.

However, because of $0 trading fee's offered now by brokers like Fidelity ... we have decided to change our strategy for dividend reinvestment.

The bottom line is that regardless of the method ... we are still continuing to reinvest 100% of our dividends to further compound our future income.

At the time of this writing, we are shareholders of Consolidate Edison (ED) stock. This article is not an endorsement to buy this stock but rather gives an example of the benefits of long term dividend investing. Please do your own research on what investments to buy/sell.

Its like the proof ,the system works.I still do some drips like where dividends are small due small amount shares and large prices like BA,AVGO etc.Other dividends are pooled and purchased

Is the rationale behind stopping the drip is so you can reinvent yourself and find stocks at a better prices?