This post may contain affiliate links. Please read our disclosure for more info.

Just over 10 years ago when my wife and I bought our first dividend stock, we didn’t realize the impact it would have on our retirement. While we are still many years away from our magic financial independence number, we now realize that dividend income will be an important tool we use one day.

Some people may rely on building a real estate portfolio to help them reach their FI number. Others may start a business to build income.

My wife and I chose dividend stocks as our partial path to FI. We plan to use several other tools to hit our financial independence number one day … with dividend income playing a key role.

So just how much has our dividend income stream grown over the past decade (or just over a decade)? Let’s take a look.

Building a Sustainable Income Stream from Dividends

One of the best ways to build a sustainable income stream is from investing in quality dividend stocks. There are certainly other ways … but this is the method that my wife and I picked.

Over the past 10+ years, we have seen our dividend income grow by leaps and bounds.

And one day in the future, if allowed to compound, our portfolio of dividend stocks will really grow into something substantial.

Let’s take a look at our growth over the last 11 years … since earning our first dividend payment.

How Much Has Our Dividend Income Grown in 11 Years?

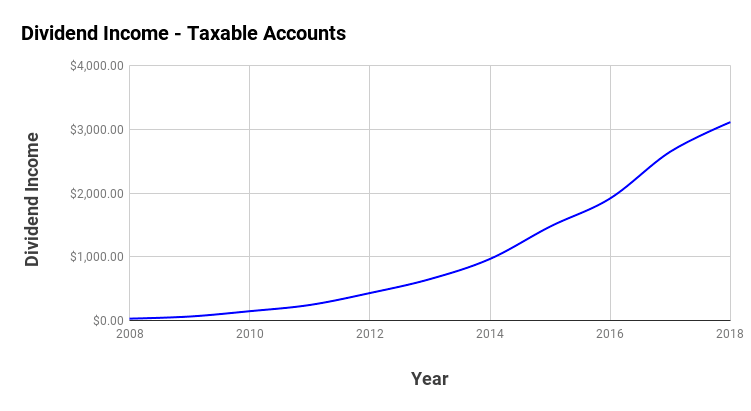

The first year my wife and I earned any dividend income from our taxable accounts was in 2008. That was right at the beginning of the Great Recession, which turned out to be a wonderful time to start building our dividend income portfolio.

Over the past 11 years, we have seen our annual dividend income grow from $29.46 in 2008 up to an all-time high of $3,115.46 in 2018.

Overall we have earned a total of $11,689.89 in dividends since beginning that portfolio (2008 to 2018).

Note – All figures and income totals quoted here are dollars earned from our taxable brokerage accounts, which we have been tracking since 2008. We also are now earning dividends from retirement accounts, which we started tracking in 2017 separately.

Here is an illustration as to how our dividend income has grown over the past 11 years.

A lot of our growth can be attributed to new investments made over the years.

For example, over the past 2 or 3 years we have invested around $10,000 annually into building our portfolio. Over the next 10 to 20 years, we will see the benefits of these investments.

In addition to new investments, we have also seen a lot of growth from annual dividend increases from the companies we own.

Part of our investment philosophy is to hold onto our dividend stocks as long as the company continues to raise their dividend annually. So far … that strategy has worked out well.

The last way we have grown this income stream the past 11 years is by reinvesting every single dollar earned (all $11,689.89) back into new shares of stock. This is about the equivalent of how much new money we are investing each year.

So where does our dividend income portfolio go from here?

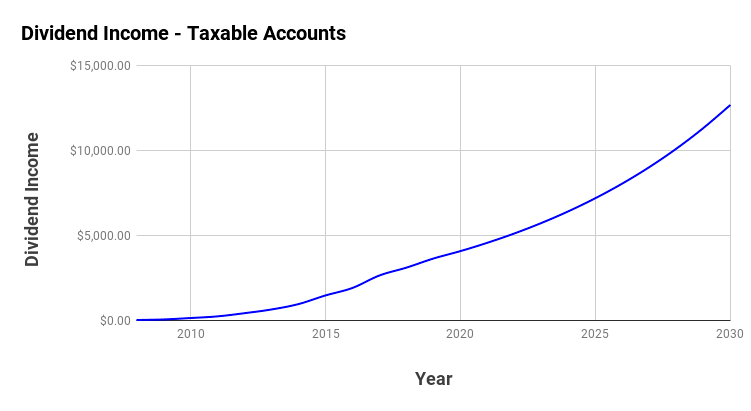

I recently mapped out how our dividend income could look by the year 2030.

Based on our financial independence calculations, this is the first year (2030) where I would consider leaving my current full-time job.

How Much Dividend Income Will We Earn per Year By 2030?

Based on our 2018 dividend income earnings, we are forecasting to earn $3,650 in dividends from our taxable brokerage accounts this current year (2019).

Then using a 12% annual growth rate for our dividend income over the next 11 years (2020 to 2030) … we can expect to earn $12,696.71 annually by 2030.

The illustration below shows the overall growth up through 2030 (2008 to 2030).

Why are we using 12% annual growth rate?

Based on performance over the past 11 years, we feel we can continue to grow our portfolio by 12% or more annually. To date, the lowest annual increase has been 17.2%.

In addition, our portfolio should grow by 8% to 9% annually from dividend increases (5% to 6% on average) and dividend reinvestment (2% to 3%). This is growth all on it’s own with no new investments.

The difference will be made up from new investment dollars … around 2% to 4% annual growth.

We realize a 12% sustained annual increase is a bit aggressive … but it is something we think we can accomplish.

Using our current spending estimate of $60,000 per year … we can estimate that dividend income (from taxable accounts) would cover approximately 21% of our expenses by 2030.

That isn’t too bad … but our goal is to cover at least half of our spending from dividend income.

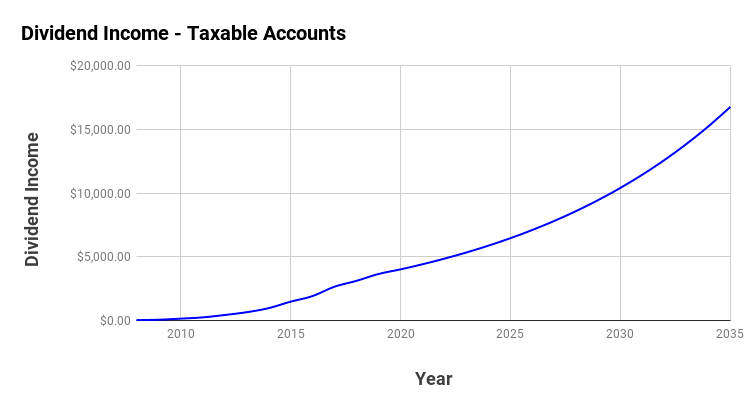

So let’s look at what our dividend income would look like 5 years later (2035).

How Much Dividend Income Will We Earn per Year By 2035?

One of the most powerful tools you have at your disposal for building wealth is compounding interest.

For example, if we waited another 5 years and let our dividend income portfolio grow by 12% … our results would almost double!

By the time 2035 rolls around, we could be earning $22,375.94 in annual dividend income!

That is a 76% increase compared to the $12,696.71 we were earning back in 2030.

Just look at the awesome compounding growth over those extra 5 years!

If we can wait until 2035 to start using our dividend income … we could cover 37% of our current expenses.

Remember also we are only calculating our dividend income earned from our taxable accounts. Those are the dividends that we can use today or anytime in the future and don’t have to wait until age 59.5.

Note – We expect to earn about the same amount ($26,700) by 2035 from our retirement accounts. So combined that covers almost $50,000 worth of expenses.

Why Are We Focused on 2030 and 2035 for Financial Independence?

The years 2030 and 2035 are important in our financial independence plans for a couple of reasons.

First, the year 2030 will be the my first chance at receiving a partial pension from my current job. This amount is subject to change, but the partial payment I would be eligible for would cover approximately 38% or our expenses (pre-tax).

Along with our dividend income (from 2030), we could cover almost 60% of our current expenses.

However, if we wait until 2035 … my pension jumps up to cover 71% of our current expenses (pre-tax). Add in our estimated dividend income for 2035 and we would be able to cover 108% of our current spending.

I like that number a lot more!

So as you can tell … those two different years (2030 & 2035) are significant to our financial independence plans.

One additional factor is that sometime around 2033 to 2034 … we would start getting access to our retirement accounts. Most important is having access to that extra dividend income stream from our retirement accounts.

Our Financial Independence Path

Our path to financial independence (FI) likely looks a lot different than yours.

If I could go back in the past … I would have started building our plans for FI much sooner.

We would have started that dividend income portfolio earlier.

Probably started investing in real estate for monthly cash flow.

Building a small business for additional income probably would have been part of our plan too.

But none of these things happened … which is okay, because we have a different plan. We just didn’t start this plan as early as we would have liked is all.

Our financial plan we are working on now will rely on the following –

- future expenses are consistent with current expenses

- use taxable dividend income to offset some of our expenses

- use dividend income from retirement accounts after I turn 59.5

- start drawing on my pension in either 2030 or more likely 2035

- build a side hustle to earn between $10,000 to $20,000 annually (this is more of icing on the cake type of thing)

One other thing I would like to point out about expenses … we expect future expenses to be similar to our current spending. Healthcare spending would likely be much higher and possibly the cost of college for our youngest child by that time.

But on the other hand … we hope to have little debt. No mortgage or car payments for example. And we should have 2 of our kids out of college by then … so we won’t be spending as much on our kids by then.

And one last item … we don’t account for social security anywhere in our plans for the time being. Just like building a side hustle to keep us busy and earn some income … social security would be extra in our financial independence plans.

As you can tell from the numbers I have shared above, building dividend income is part of our FI plans. It doesn’t make up our only source of income but rather just a portion of it.

If it were to completely go away, then we would need to adjust our plans … but at least it doesn’t completely wipe them out.

Do you plan to use dividend income as part of your financial independence plans? What percentage of your spending will be covered by dividend income once you hit FI?