This post may contain affiliate links. Please read our disclosure for more info.

It certainly seems like 2016 is just flying by. It won’t be too long before we are evaluating our annual dividend income at the end of the year. In the meantime, let’s take a look at our dividend income results for the month of April.

Here is our dividend income portfolio results for April, 2016 –

2016 April Dividend Income Results

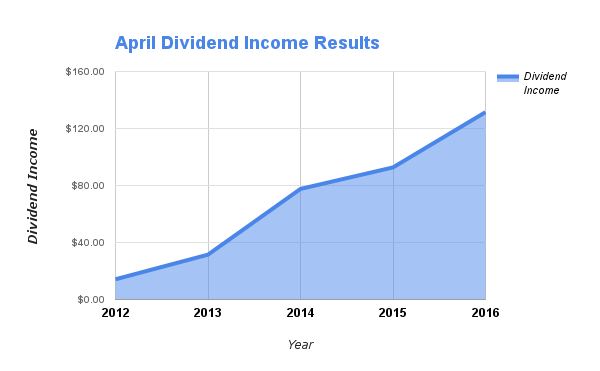

I love reporting back on past results to see how much we have grown. Look at how little dividend income we earned ($14.19) just 4 years ago in April.

Take a look at the growth we have seen over the past 4 years based on April dividend income results –

- April 2012 – $14.19

- April 2013 – $31.48

- April 2014 – $77.60

- April 2015 – $92.69

April 2016 Dividend Income – $131.46

We saw an increase of over 42% last month compared to April 2015!

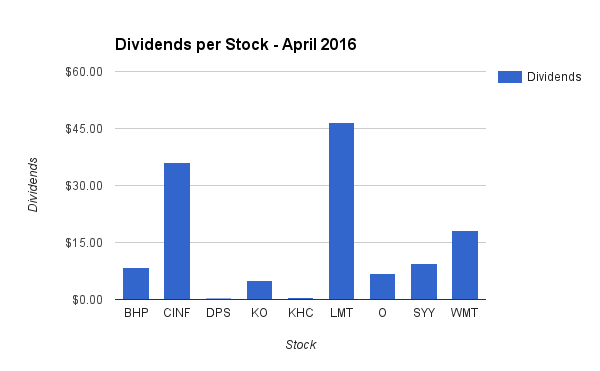

Here is the breakdown of dividend income (by stock) in April –

- BHP Billiton Limited (BHP) – $8.32

- Cincinnati Financial Corp (CINF) – $36.10

- Dr Pepper Snapple Group, Inc. (DPS) – $0.34

- The Kraft Heinz Company (KHC) – $0.45

- The Coca-Cola Company (KO) – $4.97

- Lockheed Martin Corporation (LMT) – $46.65

- Realty Income Corporation (O) – $6.97

- Sysco Corporation (SYY) – $9.56

- Wal-Mart Stores Inc (WMT) – $18.10

Note – All of the dividends we currently receive are reinvested into new shares of the same stock using DRiP – except those purchased through our LOYAL3 and Robinhood accounts.

Stocks Sold in April

I discussed it recently here on The Money Sprout about knowing when to sell a dividend stock. Well, my wife and I finally decided to dump two stocks that cut their dividends earlier in the year. We should have taken action as soon as the cuts were announced but waited several weeks.

We sold all of our shares in the following two stocks –

- 20.409 shares of ConocoPhillips (COP) – $961.26

- 26 shares of BHP Billiton Limited (BHP) – $845.52

Shares of ConocoPhillips were held in our Fidelity account, so we paid a commission of $7.95 to sell the shares. Our BHP Billiton shares were purchased through our Robinhood trading account – so the good news is that there are no fees!

So far, we have used a large portion of the funds from the BHP sale to invest in the following stocks in Robinhood –

- $594.40 lump sum investment in Archer Daniels Midland (ADM) – 15 shares

- $202.47 lump sum investment in Aflac Incorporated (AFL) – 3 shares

Archer Daniels Midland had been a stock on our radar for some time and we purchased our first shares for the Money Sprout Index.

As far as Aflac Inc., we have owned shares in this company for many years and have been adding to our position periodically. I think it is a great dividend income growth stock, so we added to our current position.

We are still looking for our next new stock to add using the funds from the COP sale in our Fidelity account.

New Capital Invested in April

Regardless of which direction the market is going, we have been dedicated to investing new money into dividend stocks. Here are the new investments we made in April –

- $25 automatic investment in Dr Pepper Snapple Group, Inc. (DPS) – .28 shares

- $25 automatic investment in Kellogg Company (K) – .32 shares

- $25 automatic investment in The Coca-Cola Company (KO) – .54 shares

- $25 automatic investment in The Kraft Heinz Company (KHC) – .32 shares

- $150 automatic investment in Microsoft (MSFT) – 2.73 shares

- $50 automatic investment in Unilever (UL) – 1.05 shares

- $50 automatic investment in Verizon (VZ) – .92 shares

- $150 automatic investment in WalMart (WMT) – 2.17 shares

We had our normal automatic investments in WalMart, Verizon, Unilever, Microsoft, Dr Pepper Snapple, Kellogg, Coca-Cola, and Kraft Heinz through LOYAL3 and Computershare.

The plan is to really start increasing our new investments starting in May through the end of the year. We have finally caught up on a lot of extra spending from the end of last year and repairs I needed to make on my car.

The total amount of new capital invested in April was – $500.00

Here are the new investment totals for the year –

- January Investments – $518.30

- February Investments – $527.49

- March Investments – $584.08

- April Investments – $500.00

New 2016 Investments – $2,129.87

Note – We used to track our 12 month forward income in these posts. However, we have decided to drop this information from our monthly updates as it gets cumbersome to track. We plan to instead provide quarterly updates on our progress.

Conclusion

The dividend income earned in April ($131.46) was up over 42% from the same time last year. This is all a direct result of pumping more and more money into the stock market.

Based on the quarterly dividend payout cycle, April has never been a great month for income. Just four short years ago we didn’t even earn $15 in dividend income during the month of April. Now look at our earnings – well over $100 for the month and continuing to grow.

Starting in May, we really need to pump a bunch more new money into shares of dividend growth stocks. Our 2016 goal is to earn $2,250 in dividend income. At this point, we are on pace to earn a little over $1,670 in dividends for the year. While that is above last years totals ($1,475) – it is well below our goal.

How was your dividend income in April?

Full Disclosure – At the time of this writing, we owned shares in the following stocks noted in this post – ADM, AFL, CINF, DPS, K, KHC, KO, MSFT, LMT, O, SYY, UL, VZ, and WMT. The material above is not a recommendation to buy. Please do your own research on a company before deciding to invest.